Domestic stocks managed to post a positive year, although the advance was not as broad-based as prior years with mid-cap and small-cap stocks producing only about half of the gain of large stocks. Foreign stocks were negative for the year due to weaker performance from international markets, and the impact of a stronger dollar. For bonds, long-term treasury bonds rebounded from their poor performance in 2013, and high yield corporate bonds had a subpar year as weakness in energy prices weighed on the bonds of energy companies, one of the largest segments of the high yield bond market.

As I look at where stocks stand after this past year, risk has increased, which is not good, but we have also had a couple of events happen that should make it easier to navigate the current environment.

The stock bubble is getting bigger

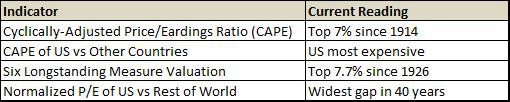

In prior commentaries I have frequently discussed the danger posed by above-average market valuations and below-average growth in the underlying economy. While valuations do not tell you much about the short-term direction of the financial markets, they are very useful in regard to longer-term direction. A quick summary of some of the factors showing these “bubble” level valuations in the U.S. are as follows:

The challenge with valuations at these levels is that there is very little room for negative surprises. An increase in negative new surprises could trigger a potentially large decline in stocks as investors become increasingly nervous that new buyers will disappear with stocks at these rich valuations. Value-oriented investors would have to see earnings go up significantly, or a sizeable drop in stock prices before seeing attractive buying opportunities. Over the past few years the most likely triggers for a stock decline have been items such as economic weakness, rising interest rates, and inflationary pressures. While the risk of renewed economic weakness continues to persist globally, the United States has been able to achieve stronger economic growth than most other places in the world, even though the growth is weak by our historical standards.

As our economy has struggled to achieve acceptable economic growth levels after the recession, the Federal Reserve has enacted a series of Quantitative Easing programs to stimulate the economy and lower interest rates through the direct purchase of bonds. The stock market has become more volatile as interest rates have begun to move, or look poised to move higher. With the end of the most recent quantitative easing program and talk of raising interest rates in 2015, there has been an expectation that rates would increase, causing significant problems for stocks, but the increase in interest rates has yet to happen.

Government bond yields are getting smaller

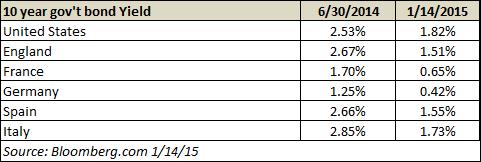

In recent months we have seen the level of inflation slowing across Europe, and it is not just due to falling energy prices. Inflation is slowing even if you exclude food and energy, and there is a real chance that Europe may see deflation and a slide back into a recession during the year. In response, the European Central Bank (ECB) has been laying the groundwork to begin a quantitative easing program similar to the one that the Federal Reserve has been doing in the U.S. over the past several years. The ECB program began with some initial bond buying in September and the program is expected to be increased later this month. The expectation of a large bond buying program by the ECB has brought down interest rates across Europe, and has impacted global yields on bonds as investors are searching globally for attractive rates. A brief example of the change in yields since the end of June is shown below:

This decline in global yields has created more demand for U.S. treasuries, mitigating the reduction in bond buying by the Federal Reserve. That has allowed interest rate levels to be maintained, and to actually move lower as well. It is likely that this lower level of interest rates will persist until Europe sees their deflationary risks alleviated, and it should provide a more positive backdrop to the U.S. stock market as investors who were waiting to invest in bonds at higher yield levels may now shift those purchases to stocks.

These recent events are currently positive for U.S. stocks, and there is an increasing chance that if stocks move further above historically normal valuation levels with no ill effects, many investors will begin to believe that these risk factors no longer matter and may become increasingly aggressive in their asset allocation to stocks. As a result, we could see a repeat of the late 1990’s type of bubble where stocks become increasingly expensive and the market advance becomes increasingly narrow in regard to the number of countries and sectors of the market participating in the advance.

In a market environment like we had in the late 1990’s, we have found that our models that measure the internal trends and momentum of the market performed the best. They did experience a higher level of volatility that will more closely track the movements of the market on declines of less than 10%. In the past couple of months we have begun to more heavily weight the input of these models into our asset allocation decisions, and plan to continue to do so if the low interest rates and parallels to the late 1990’s persist because it will allow us to capture more of the market upside if the bubble continues to grow.

In our next commentary I will discuss the impact of the European Quantitative Easing program on the bond markets. Have a great 2015!

Michael Ball

Lead Portfolio Manager

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.