Quantitative Easing (QE), the U.S. Federal Reserve’s (Fed) emergency economic stimulus bond-buying program since 2009, came to an end in October 2014. Results of the quantitative easing were an improved labor market, economic growth picked up and the stock market rallied. Despite the end of QE, the Fed has maintained a loose monetary policy with a benchmark interest rate near zero. Concerned that keeping an expansionary policy in place for too long could cause asset bubbles and runaway inflation, the Fed is anticipating an interest rate rise in the near term.

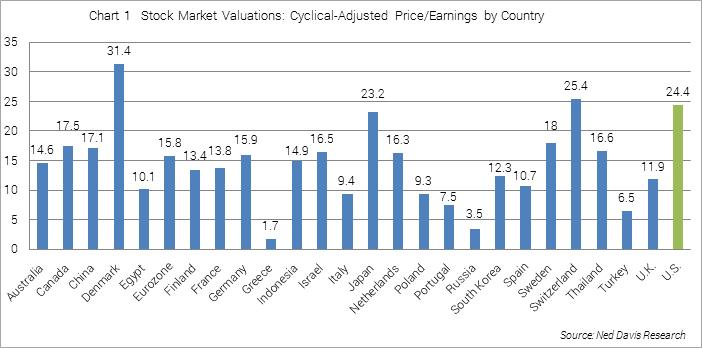

Recently Fed Chairwoman Janet Yellen highlighted that “equity-market valuations are quite high ,” which is in line with our concern of a relatively expensive stock market (See chart below). However, outside the United States, countries seem to be moving in the opposite direction. Sluggish economic growth and low inflation have urged the majority of global central banks to aggressively join the monetary easing club. 25 central banks around the world have cut interest rates this year alone and the European Central Bank (ECB) has resorted to a quantitative easing program.

Foreign central bank’s moves to accommodative monetary policies show their reactions to economic ills. Two larger economies that could have a global influence include China and Europe. As the world’s second largest economy, China has been the global growth engine for years but recently has been losing steam. The slowdown in economic growth in China could send ripples through the global economy and drag down other countries with it. However, if China can steer its economy to a soft landing and maintain sustainable growth, it will bolster the worldwide economic recovery and China will once again position itself as a key player in the global economy.

According to the World Bank’s latest report, global growth in 2014 was lower than initially expected. Depressed commodity prices and persistently low inflation rates has left global central banks with no choice but to loosen their monetary policy. China is the largest economy among those who have cut interest rates. It hopes the monetary move will effectively reduce business costs, stimulate economic activity and bolster domestic demand to avoid a hard landing. The European Central Bank has introduced quantitative easing to inject more liquidity into the market and encourage investment, hoping for the same level of success seen in the United States.

Although foreign central banks’ easy money strategies most likely will improve their own economy, their currencies may become less attractive and therefore depreciate. Meanwhile, the U.S. is expected to raise interest rates, leading to a strengthening dollar, which hurts U.S. exports and companies that depend on overseas sales. A sharp drop in exports could hamper economic growth. Additionally, as imports become cheaper, it will cause downward pressure on the price level which will make the Fed’s inflation target even more difficult to accomplish and reduce domestic demand. The slowdown of growth and disinflation in the U.S. could become contagious to other countries and further challenge the global economic recovery.

If the U.S. dollar continues to appreciate, global investors will continue to seek investments that benefit from a strengthening dollar. This could potentially cause a stock market run-up with a potential for asset bubbles and an overvaluation of the dollar. If a correction begins to unfold, asset prices may plummet along with investor and consumer confidence. As people pull their money out of the U.S., the decline may be hard to remedy. You can be sure that the Fed is keeping a watchful eye on the recent climb in the U.S. dollar. The Fed needs to consider factors both inside and outside of the U.S. and come up with a safe timing for the interest rate raise. We operate in a more connected global economy today than we did 20 years ago. At Weatherstone, we monitor and report this type of data because it can have a significant impact on our markets and thus your managed accounts. Thoughtful investing has become a challenging endeavor for most people. We take the charge very serious and will continue to monitor and take the very best care of the trust you place in us.

Xiaoyu “Daisy” Ma

Analyst

Sources: http://www.wsj.com/articles/feds-yellen-cites-progress-on-bank-regulation-1430918155

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.