After a 12-year bull market (the longest in history), the U.S. equity market has entered a bear market losing 30% from peak to trough. As we’ve discussed in the past, the markets hate uncertainty, and this is exactly why the markets are reacting so dramatically to the COVID-19 Coronavirus. We will discuss some of the many factors at play, but ultimately, the markets have priced in a recessionary event. While there is the possibility that the U.S. will experience a recession (two consecutive quarters of negative GDP growth), we do not yet know that is a certainty. We do expect to see a meaningful decline in GDP in the 2nd quarter, with the potential to contract by 10% like we saw in the Asian Flu Crisis of 1958; however, we believe that growth will return rapidly in the second half of the year.

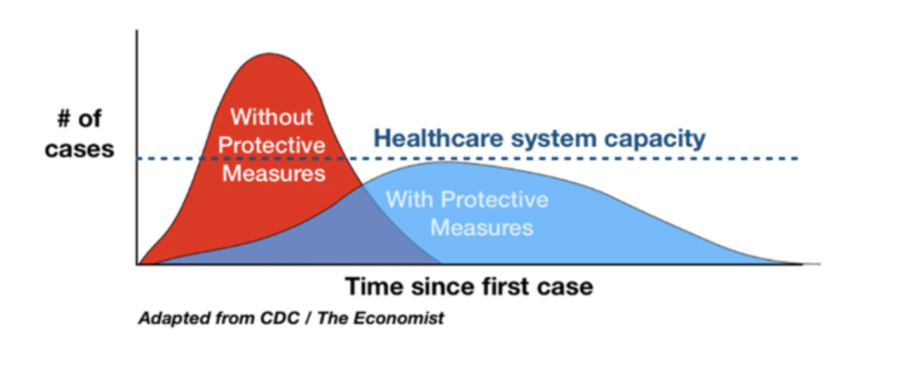

The reason that we expect such a contraction is due to the expected rapid spread of the Coronavirus and the corresponding preventative measures that have been put in place to slow that spread. Some cities have already mandated residents to stay home, effectively shutting down those cities. It is important to remember that the purpose of these efforts is to reduce the number of cases at a given time and to put less stress on our healthcare system.

Countries like China and South Korea appear to have been successful in slowing the spread, and infection rates do appear to have stabilized. Parts of Europe are starting to show signs that the daily level of new cases is slowing and it is our expectation that the U.S. will likely follow this same trend. The U.S. has been proactive in taking preventive measures, and it is possible that those measures may go further if recommended guidelines are not followed.

From a policy response standpoint, many measures have been, and are being taken to position the U.S. economy for an optimal long-term outcome. Instead of waiting for the scheduled meeting on Wednesday, the Federal Reserve slashed the Fed Funds rate to 0% on Sunday afternoon. Concerned with the possibility for unexpected funding needs, the Fed wanted to ensure that banks have ample capital and liquidity to assist both businesses and individuals. Additionally, Federal Reserve Chairman Jerome Powell stated that the Fed will remain patient, meaning rates should be low for a while. It is also unlikely that the Fed will use negative rates, which we see as a good thing. Congress has passed a Coronavirus bill through the House and the Senate is now working hard to move this bill forward. What this final bill will look like is yet unknown, but many of the approaches that are being contemplated would provide support to a stronger economic recovery. It is our thought that government is acting thoughtfully and with purpose, and that these efforts will pay dividends once we are through this event. These actions should give investors some level of comfort. Unfortunately, this is not yet what is being seen by some fear indicators. Individual investor fear levels are maxing out; however, institutional investor sentiment levels are moving higher.

This deviation in sentiment levels has historically boded well for the equity markets. It is likely the volatility in the markets will continue, and we should note that the sheer magnitude of options, futures, index strategies, and ETFs have exaggerated the intraday swings we have seen in the markets. New information also has the ability to shift these sentiments quickly. Additionally, we believe that when the markets do stabilize and once the selling subsides, actively managed equity and fixed income strategies should benefit meaningfully. One example of why we believe this to be the case can be seen with index strategies. As investors pour out of these types of investment vehicles, those strategies must sell the underlying securities. As a result, the larger market cap companies have more dollars flowing out, and without buyers on the other end yet, supply and demand dictates that even very strong companies are being punished at levels that would not be fundamentally supported. There are certainly a number of companies and industries that are being punished at appropriate levels, such as Cruise Lines, Airlines, Retail, and Restaurants. Clearly these companies will have much more difficulty working through this time. This disconnect offers opportunities for well-positioned investment strategies to shine over the long run.

As far as economic data goes, it’s still early, and there is not a significant amount of relevant data available yet. We do believe it is undeniable that there will be a meaningful economic impact over at least the next quarter. We feel that the markets have already priced in this eventuality, and that valuations look attractive for long term investors. That’s not to say there won’t be more pain ahead. There will certainly be more volatility, but what will happen in the short term is unknown. There will likely be some job loss and some companies will struggle. We also expect the 2nd quarter to look pretty negative economically. That said, we do expect growth to return quickly, and for the markets to bounce back and resume course once the Coronavirus is behind us.

Whether or not we enter an official recession is yet unknown. There’s no doubt there will be a substantial shorter-term economic impact. This is an event-driven economic downturn, which generally results in a sharper recovery. Additionally, it’s important to remember that typically stocks begin rising 3-6 months before the actual economic recovery. We understand that this is an emotionally trying time, and that there are still many unknowns. While this downturn is unpleasant, black swan events like the Coronavirus are part of investing. Your financial plan and asset allocation do anticipate these types of events will occur over time, and now more than ever, it is critical to adhere to your investment strategy. We feel confident in our current positioning, and we will continue to make shifts to take advantage of opportunities these markets present. We continue to watch the news and data feeds incredibly closely, and stand ready to make further positioning changes for our clients quickly if anything fundamentally changes. Should you have any concerns or just want to talk, please reach out to us. It is always prudent to evaluate your current risk tolerances and this discussion is always welcomed. We value your continued trust.