The first quarter of 2015 is now in the books. It was a choppy quarter with little return for the stock and corporate bond markets. The stock market as measured by the S&P 500 gained less than 1% for the quarter, while experiencing four declines of 3% or more since late December. January and March were both down months, and February was quite strong. Corporate bonds were also up about 1%, with high yield bonds performing well, and gained about 2% for the quarter as oil prices began to stabilize (1).

One of the primary reasons that stocks have had a difficult time making headway the past three months is that earnings and earnings estimates have been turning increasingly negative as we have gone through the quarter. According to data provided by FACTSET, expected earnings growth for the first quarter of 2015 was at +4.3% as we entered the year, however the current expectation is now for a decline of -4.8% for the quarter. This is the largest decline in earnings estimates since the first quarter of 2009, when we were still in a recession.

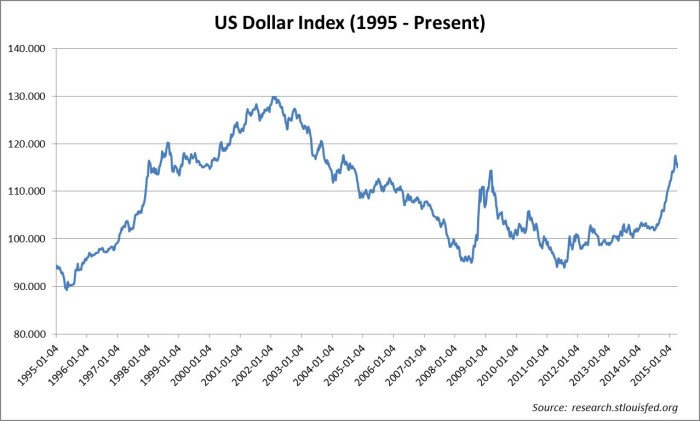

The primary reason for the significant decline in earnings growth has been the sharp decline in the value of foreign currencies relative to the dollar. On December 31st of 2014, one euro was equal to $1.21. On March 31st, one euro was worth about $1.07 (1). A move of this size in such a short time frame is very rare, and even companies that have typically been quite good at hedging their foreign currency risk were not well prepared for a move of this magnitude. Additional factors are the continued weakness in energy prices, the west coast port strikes, and severe winter weather in the northeast. The impact is expected to last at least through the second quarter and earnings are expected to resume their growth in the third quarter. Extended earnings declines of three quarters or more have historically been negative for stocks and frequently precede the start of a bear market, so we will be watching the earnings trends carefully, particularly in light of the current high valuation levels.

The factors that have been negatively impacting earnings are also weighing on domestic economic growth, with current estimates showing an expected growth of only 1.6% in the first quarter. Now that winter weather is behind us and the port strike is over, growth should rebound in the second quarter and expectations are that full year economic growth will be slightly higher in 2015 than in 2014 (2.5% vs. 2.4%). Although this number remains weak by our historical standards, it remains quite good relative to the rest of the world.

As we move into the second quarter, the positive factors impacting the market environment are a continued decline in global interest rates and most of the stock markets around the world moving higher. Neutral factors include a narrowing market advance in the United States as measured by the number of advancing sectors and industries. Negative factors continue to be market valuation, the length of time that the markets have gone without a significant correction, and a generally weak global economic environment with a threat of deflation.

On an overall basis the market environment is neutral and we will remain invested in stocks and corporate bonds until our market based measures of risk signal more negative readings. Our models favor sectors of the market that are continuing to show strong earnings and revenue growth, such as health care, defensive sectors such as consumer staples, and sectors that can benefit from lower oil prices such as consumer discretionary. The models that measure international markets have turned more positive, but the strong move higher in the dollar has offset much of the strength in foreign markets. We have increased our international exposure as positive data out of Europe shows that the early stages of Europe’s quantitative easing program has been able to stimulate economic growth across the region. We are hopeful additional stimulus will continue to increase European economic growth and ignite a sustainable stock market rally that could narrow the valuation differences that exist between our domestic stock market and most foreign markets. One significant concern that we have for foreign markets is that the recession probability model we follow for foreign countries has been deteriorating and is now showing above-average probability of a recession, so we will continue to monitor the changes in that risk model closely and make adjustments as needed.

In the fixed income markets we continue to like high yield corporate bonds as long as oil prices can remain stable, and we have also been increasing our weighting to preferred stock which is providing attractive yields near the 6% range. With strong earnings projected in 2015 from the financial sector, which is the largest issuer of preferred stock, we are very comfortable investing in the preferred stock asset class.

We remain alert for a long overdue stock market correction, and currently feel that the most likely catalysts for moving our models and indicators out of the neutral environment are likely to be caused by unexpected changes to the path and potential level of any interest rate hikes this year by the Federal Reserve. We are also concerned that deflation, based upon core consumer prices could become prevalent in economies around the world, or that a sharp increase in debt defaults could occur in China as their economy slows. We will be watching these developments closely to see if any of these issues become a flashpoint, and for the impact that they may have on our investments.

Michael Ball

Lead Portfolio Manager

Sources & Disclosure

(1) finance.yahoo.com

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. The S&P 500 Index is an unmanaged market capitalization weighted price index composed of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and Over-The-Counter market. Indexes are provided exclusively for comparison purposes only and to provide general information regarding financial markets. This should not be used as a comparison of managed accounts or suitability of investor’s current investment strategies. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. The value of the index varies with the aggregate value of the common equity of each of the 500 companies. The S&P 500 cannot be purchased directly by investors. This index represents asset types which are subject to risk, including loss of principal. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.