- Floating rate bank loans have proven to be an attractive investment during the recent rise in long-term rates

- Floating rate bank loans can work as both an interest rate and inflation hedge

- When the Fed begins to raise short-term rates and the yield curve flattens, bank loans will be a good alternative to short-term fixed rate debt securities

The recent rise in mid- and long-term interest rates has left many fixed income investors who failed to position their portfolios accordingly with a despairing feeling that comes when something bad happens. Investors who tactically moved their portfolios out of longer-term fixed income securities and into short-term securities and cash are looking like Wall Street all-stars. Now, as investors sit in short-term securities, they need to be preparing for the second chapter of the dynamic interest rate environment. One investment vehicle of real interest in this challenging interest rate environment is floating rate bank loan funds. They are of particular interest to Weatherstone and have been used in a number of the asset allocations and continue to be attractive. Because of this we wanted to introduce them in greater detail and talk about why floating rate bank loans have proven to be an attractive investment during the recent rise in long-term interest rates. In addition, their true value will likely begin to shine as short-term interest rates begin their ascent.

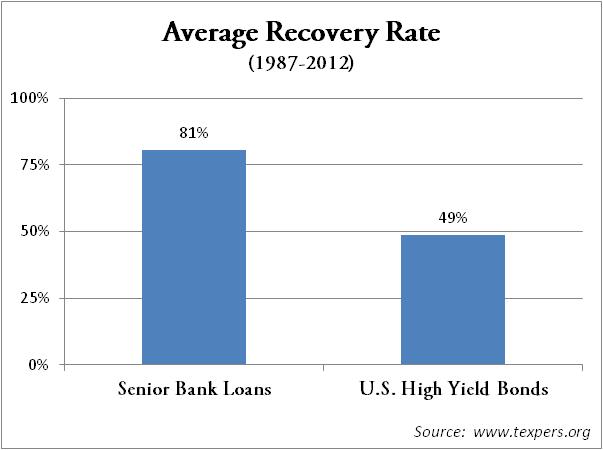

Floating rate bank loans are loans made to companies, usually with some collateral attached to the loan. The rate charged by the bank is based off of the London Interbank Offered Rate (LIBOR). LIBOR is the interest rate that banks charge to borrow from one another. When banks issue floating rate loans, they use LIBOR as the base rate and add a premium (usually 3-4%) based on the credit profile of the company and the quality of the collateral. The coupon rate for each loan essentially resets every 30-90 days. Currently, the weighted average days to reset for the PowerShares Senior Loan fund (BKLN) is approximately 32 days (BKLN is provided as an example and is not a recommendation) (1). The primary reason interest rates rise is to fight inflation. In a sense, since senior loans’ coupons reset quarterly, they can work as both an interest rate and inflation hedge.

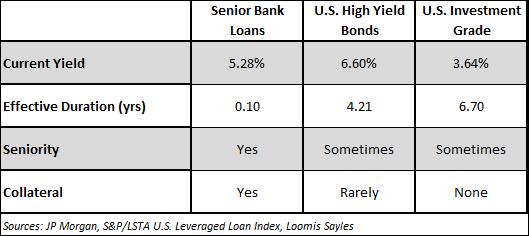

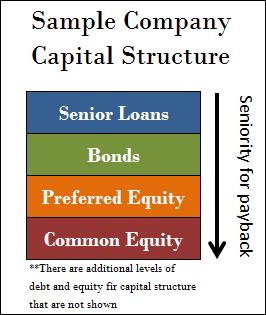

The majority of a bank loan fund holdings are in senior secured loans which are considered to be the least risky part of a company’s capital structure. The “senior” portion of the loan means that if a company faces financial hardship, the holders of the bank loan have seniority on the list of creditors to be paid back in the event of default. The “secured” portion of the loan refers to collateral that is tied to the loan such as property, inventory, and even intangible assets such as patents. Both the “senior” and “secured” elements of bank loans have historically proven to be beneficial to investors as shown by the high recovery rate in the event of default.

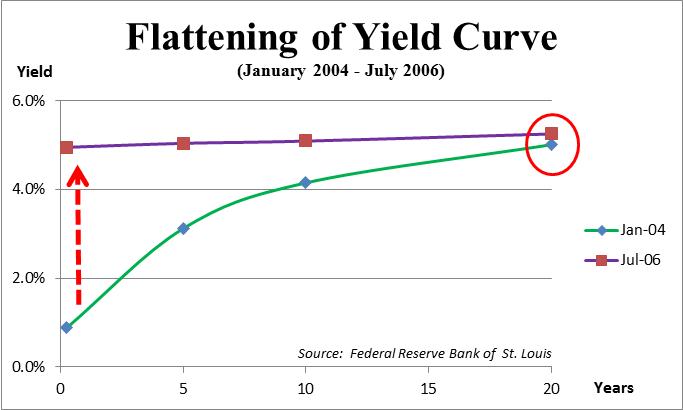

The recent moves in interest rates have primarily been on the mid- to long-term end of the yield curve (the yield curve depicts interest rate levels of bonds with equal credit rating maturing at various times) as investor’s position for the end of the Fed’s QE program. As a result, bank loan funds and their corresponding coupon rates did not receive much of a benefit. However, investors who shifted from longer duration securities and into floating rate funds prior to the move did not see a negative impact from the interest move either while fixed income securities with longer durations experienced large capital losses. As the yield curve flattens bank loans will be a good alternative to short-term fixed rate debt securities.

Currently, the yield curve is historically steep and has many similarities to the environment in 2004 when the Fed began raising the fed funds rate (short end of yield curve). Although the overall level of rates is significantly lower today, the structure of the yield curve is very similar. The Fed raised the Fed funds rate by .25%, 17 consecutive times from June of 2004 to June of 2006(2). As shown in the chart below, while the short end of the yield curve went from 1.25% to 5.25% over this period, the long end of the yield curve remained relatively stagnant.

The Fed has stated they will not raise the Fed funds rate until mid-2015, the market will undoubtedly begin raising short-term rates on the secondary market well before then. For example, when the Fed raised the Fed Funds rate was back in June of 2004 the yield on the 3-Month T-bill moved from an average rate of less than .90% in January to more than 1.25% in June (3). Investors are currently reaffirming the Fed’s stance and have held the 3-Month T-bill’s yield near 0%. As we move into mid- to late-2014 investors should keep a watchful eye on short-term treasuries such as the 3-Month T-bill for a signal as to when the Fed will be raising short-term rates. Since the Fed has set a range for the fed funds rate of 0-.25%, investors should look for the 3-Month T-bill moving above the .25% level.

Absent the 2008 financial crisis, bank loans have had a positive annual return since the index’s inception in 1997. Over this time-frame, a wide variety of interest rate environments have been seen from very steep to inverted yield curve. Bank loans have proven to provide solid returns during all of the environments. It is very important that investors understand that while bank loans are backed by collateral and are senior in the capital structure, the loans are issued by non-investment grade rated companies (credit rating of BB or lower) and should be considered when adding it to an investors’ portfolio.

We are currently in a highly uncertain time with regard to future monetary policy. In the near-term, bank loans can serve as an attractive investment vehicle to hedge your interest rate risk. During 2013 Weatherstone added bank loan positions to a number of our conservative strategies. This has proven to be a good alternative to assets with similar credit ratings whose income streams are fixed. Since credit risk is relatively high for bank loan funds, economic growth is conductive to a stable lending environment. Although growth has been tepid and forecasts for global growth remain subdued, unemployment is falling and corporate balance sheets are flush with cash. We will continue to closely monitor the interest rate environment and shift asset allocations accordingly.

Luke Nagell

Investment Committee Member

Sources: (1) http://www.invescopowershares.com/seniorloans/ (2) http://federalreserve.gov (3) http://research.stlouisfed.org/fred2/series/DGS3MO/

Disclosure: Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.