- Domestic and International Economic Challenges\

- A look into Japan’s Lost Decade

- Investment Opportunities Within a Slow Growth Economy

Economic Challenges – By Michael Ball

Over the past few weeks, the financial markets have been driven primarily by the weaker than expected economic numbers in the United States and debt worries from Europe. The big concern in regard to the European debt worries is that although these worries have been popping up for over a year, the solutions applied to the problems have thus far only managed to temporarily stem the problems, only to have them return a few months later. Until solutions are found that will build long-term fiscal stability in the European Union, we will remain under a cloud that there is a sovereign default which could destabilize many European banks and the world financial system when it is still in a relatively fragile state.

In regard to our domestic economy, the weakness that has been increasingly showing up over the summer is causing a significant amount of concern due to the fact that traditional measures for stimulating the economy, such as lowering interest rates are all but exhausted. The fiscal stimulus of the past couple of years has had lower than anticipated success in creating new jobs, and the political environment in Washington D.C. will be quite difficult to get new fiscal stimulus through if it adds to the deficit. There was a significant stock market rally from late summer through the end of April on hopes that the Federal Reserve’s latest round of quantitive easing would help to improve the economy. Now that it appears that the program did not have the desired impact, the stock market has given back as much as 70% of the gains from last year’s rally before beginning to stabilize over the past couple of weeks.

The concern for the financial markets is whether we may move back into a recession. If we do, it is quite unlikely to be like 2007-2009, and would probably be a shallow recession. However, the longer-term concern is that our economy may be going down the same path that Japan has been experiencing over the past twenty years. If we do go down that same path, successful investing will likely require greater amounts of international investing and flexibility of investment approach than most people have been used to. For additional background of the problems that Japan has been experiencing and the comparison with our current situation, see the additional commentary by Associate Portfolio Manager, Luke Nagell.

Japan’s Lost Decade – By Luke Nagell

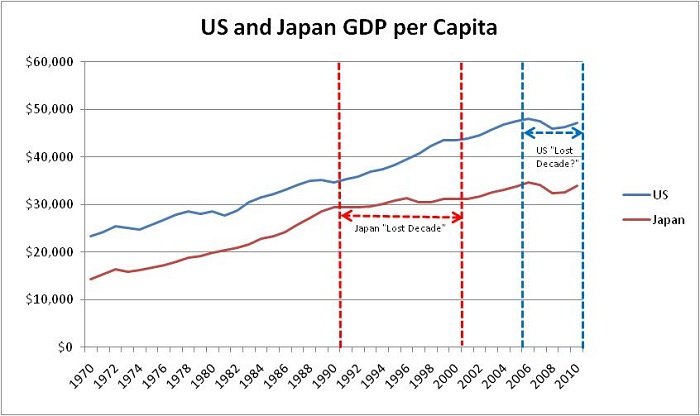

Japan’s “Lost Decade” is considered to be from 1990 to 2000, however, many regard the past two decades to be lost. The recent and current economic scenario within the US is eerily similar to what lead to Japan’s Lost Decade(s). Asset bubbles and over consumption followed by high unemployment and delayed government intervention created a perfect storm which resulted in Japan’s lost decade(s). Again, depending on who you ask, many believe that the US lost decade began in 1999 and is into its second lost decade. Although the US took drastic measures to curb a depression, there are still plenty of measures that can be taken to avoid a lost decade or dragging it on any longer.

Much like the US, Japan’s economic crisis was caused by loose monetary and fiscal policies coupled with too little regulation. From 1984 to 1989, Japan’s stock index, the Nikkei rose over 292% (1). In addition, Japan’s real estate index was rising at an unprecedented rate. When the wheels fell off, just like they always do when the party is too good to be true, asset prices in Japan began to aggressively decline. Over the ten year decade, Japan’s stock index, the Nikkei, fell over 51% from 1/1/1990 to 1/1/2000 (1).

Source: Data was retrieved from stlouisfed.org (2)

Let’s just say that the US is currently in the second half of its “Lost Decade” and that it began in 2005. The S&P 500 index closing price on 12/31/2004 was 1,211.92, the closing price on 8/29/2011 was 1,210.08. The unemployment rate is still holding steady above 9% and economists and financial institutions are revising global growth projections down on a daily basis. Perhaps the most instrumental component accelerating the US economic growth will be housing. According to the Case Shiller home price index, the January 2005 index level was at 176 and it reached its peak in July 2006 with a reading at 207. We have been bouncing around the 140 level for the last 24 months (4). With regard to the chart above, GDP per capita has been stuck at, or near, $47,000 since the end of 2004. The role that the housing industry will play will come in the form of an increase in the perceived wealth effect from rising home prices and job creation.

Our current macro view of the global economy and model signals are indicating relative strength within emerging markets and commodities. According to the Economic Times, the BRIC countries (Brazil, Russia, India, China) will be meeting this week to talk about how to help the European Union get out of its current mess (3). Ten years ago, if you would have told any leading economist or money manager that the BRIC nations (emerging markets) would be meeting to help out the EU (developed markets) they would have told you that you were crazy. The BRIC countries and other emerging countries all have excess reserves and are experiencing relatively high growth. Many of these countries are buying up commodities and strategically setting themselves up for their continued growth. In addition to opportunity within these countries, commodities, industries related to mineral extraction and the energy sector will all pose opportunity as well. Within the slower growth economies, we will be keeping a close eye on model indicators for short-term market opportunities that will arise as a result of shorter than normal advances and declines in GDP growth.

Sources

(1) finance.yahoo.com

(2) stlouisfed.org

(3) economictimes.indiatimes.com

(4) standardandpoors.com S&P/Case-Shiller Home Price Indices

Disclosure Information provided comes from independent sources believed reliable, but accuracy is not guaranteed and has not been independently verified. The opinions expressed are those of the portfolio management at Weatherstone Capital Management and not to be construed as investment advice or offer to buy/sell a security, or a solicitation which should only be provided by a qualified financial advisor prior to entering into any investment that involves risk. Investment decisions should be made based on investor’s specific financial needs, objectives, goals and time horizon. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice.