As the European Central Bank (ECB) has moved to reduce the potential for deflation in Europe, there has been a significant impact on the global interest rate landscape. This move by the ECB is likely to impact our domestic bond market for the foreseeable future. In the chart below, you can see that for more than a year the inflation rate in Europe has been steadily declining below the ECB’s target rate of 2% and has started to cause concern that deflation may begin to take hold. A deflationary environment would be a significant challenge to the countries that are trying to stimulate stronger economic growth by lowering interest rates. Deflation acts like an interest rate increase due to the fact that the price of assets tend to decrease over time when in a deflationary environment. This type of a situation can also cause both businesses and individuals to hold off on making purchases due to the belief that the cost of the assets will be cheaper in the future. The potential exists for a negative loop that can become very difficult to bring to an end.

In the United States we have maintained reasonable economic growth and stability relative to the rest of the world. As a result, the Federal Reserve has recently wrapped up their bond buying program and is talking about beginning to increase short-term interest rates. Some people say that it is not wise to raise interest rates at this time because the economy is too weak, globally there are more rate cuts than rate increases and the fact that we are increasing rates when others are cutting. The concern is that this may cause the dollar to continue to rise relative to other currencies and this may hurt earning and exports for companies that do business overseas. These are all valid concerns, but the Federal Reserve also understands that it is important to rebuild an interest rate cushion that can give them room to cut interest rates in the future if economic growth slips back toward recession. They are probably quite uncomfortable having to rely on less effective policies such as quantitative easing to stimulate the economy in the future.

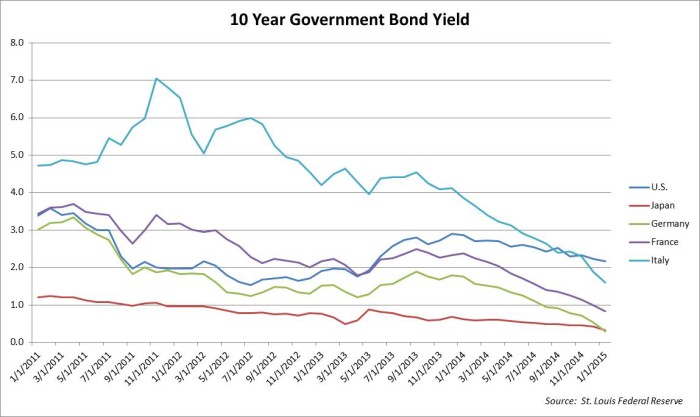

What does this mean for investors and their bond portfolios? The expectation has been that the elimination of over $80 billion per month of bond buying by the Federal Reserve would cause intermediate and longer-term government bond yields to rise. Additionally, economic strength would also allow the Federal Reserve to begin raising the Federal Funds rate. This would then result in short-term interest rates moving higher and these two events would result in an overall shift upward in the yields for both short-intermediate, and long-term rates. The fear of deflation in Europe has changed this expected outcome. From the chart below, you can see how the bond-buying program from the ECB has caused interest rates around the world, from Japan to Italy to move significantly lower. In some cases shorter-term bond yields have even turned negative in some of the strongest countries such as Germany and Switzerland. Historically speaking, this has proven to be a very rare event and one which shows the level of concern that many investors in European bonds have regarding the risk of further economic turmoil in the coming months.

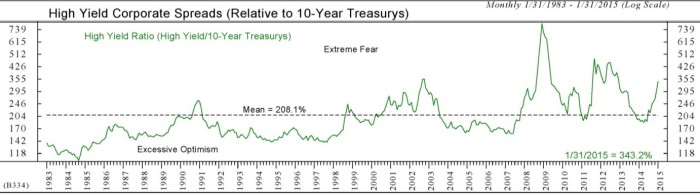

With the current low interest rate environment it would appear that there would not be any good opportunities in the fixed income marketplace. While it is true that there are fewer opportunities, and yields are below average, there are still a few areas within the income space that we find to be attractive. One are I would like to highlight is high yield corporate bonds. This has long been one of our favorite income asset classes. As the chart below shows, the yield provided by high yield corporate bonds relative to treasury bonds is at one of the widest relative levels that we have seen in about two years. This is primarily due to the decline in oil prices during the last six months of 2014 and the fact that energy companies are one of the primary issuers of high yield corporate bonds. We have felt that when oil prices started to stabilize and as economic growth in the United States remains stronger than most other places in the world that high yield bonds would begin to move back toward more historically normal spread levels relative to treasuries, and we have started to see this occur over the past few weeks. This is providing us with both attractive yields around a 6% level and some capital appreciation.

In summary, the European Central Bank’s bond buying program is having a significant impact on current interest rate levels. This has helped to keep interest rate levels from rising as the Federal Reserve has wrapped up their bond buying program. Even though we expect that the Federal Reserve will increase short-term interest rates during the year by ¼ to ½ of 1%, we don’t believe that it will cause intermediate or longer-term interest rates to move up significantly unless we see a sharp reversal in inflation expectations. And although there are fewer attractive alternatives in this environment, there are still some good areas on a relative basis that we feel can perform well in 2015.

Michael Ball

Lead Portfolio Manager

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.