Will 2021 Be a Good Year for Investments?

We have finally closed the books on 2020, and for most people it couldn’t have come soon enough. With all of the volatility from the economic impact of COVID-19 during the past year, many people are wondering if 2021 will be better for the financial markets. In this commentary, we will look at some of the major positive and negative factors that could impact markets in 2021.Indicators that suggest that 2021 could be a solid year

- The strong end to 2020 bodes well for 2021:

We ended 2020 with a gain of more than 10% in the S&P 500 Index during the final two months of the year, a feat that has only happened five times since the end of World War II. In each case the following year was higher for the stock market, with an average gain of 18.1%. While a sample size of only five cases is somewhat small, it does indicate that strong momentum at the end of a year historically has carried into the following year and provides above-average potential for good gains.

| Year | November/December Return | Subsequent Year Return |

| 1954 | 13.6% | 28.4% |

| 1962 | 11.6% | 18.9% |

| 1970 | 10.5% | 10.8% |

| 1985 | 11.3% | 14.6% |

| 1998 | 11.9% | 19.5% |

| 2020 | 14.9% | ? |

| Average | 18.4% |

Source: LPL Research, Factset

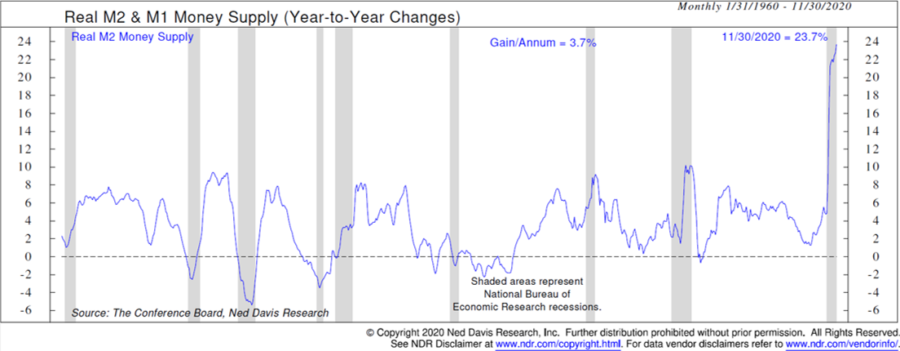

- Government support for impacted economies remains high

It is estimated that the U.S. government support to offset the impact of COVID-19 will reach nearly 18% of GDP after the signing of the most recent government relief package. Many other governments around the world have provided similarly large amounts of stimulus since the COVID-19 pandemic began. The size of these relief measures is reasonably close to the projected amount of economic output that was lost due to the virus. One way to show the impact of Federal Reserve policies to increase liquidity in the economy is to look at the growth of money supply. The chart below shows an unprecedented amount of growth in money supply dating back to the end of World War II. Some of this excess liquidity being provided to businesses and individuals is finding its way to financial markets.

- Interest rates remain low

We talked about this item in greater detail in our prior commentary, but it is worth repeating again. Central Banks both in the U.S. and across the world remain committed to keeping interest rates low for a multi-year period in order to help stimulate economic growth and ease the burden on consumers and businesses carrying loans. These low, and possibly artificially low interest rates, improve the relative attractiveness of stocks and existing bonds across the credit spectrum.

- The approval of vaccines to fight COVID-19 will help speed up a return to normalcy

Ever since COVID-19 became a pandemic, people have wondered when life might begin to return to normal. The most common scenarios either predicted achieving herd immunity or an effective vaccine. With the current approval of seven vaccines by at least one country, and 18 more in phase 3 trials, effective vaccines are becoming a reality and a number of experts are saying that life should begin returning to normal as we move through the summer months.

If these predictions are accurate, then the most severely impacted areas of the economy will finally begin to return to normal, and the economy should resume normal functioning without requiring large continued doses of government stimulus. This will result in a much more stable economic environment which will provide a higher degree of confidence to investors when they consider where to invest their savings.

Indicators that suggest that 2021 could face significant problems

While there are a number of factors like those listed above that provide a positive backdrop for the financial markets, we need to also look at the other side of the coin and be aware of factors that could make for a difficult 2021. Here are some of the offsetting factors that argue that the financial markets could run into problems in the coming year:

- Investors are too optimistic about the prospects for stocks

As the great investor John Templeton famously remarked, “The low in a bear market is also the point of maximum pessimism”. Conversely, we would expect that the high point in a bull market would also be the point of maximum optimism. Several measures indicate that investors are very optimistic about the prospects for stocks.

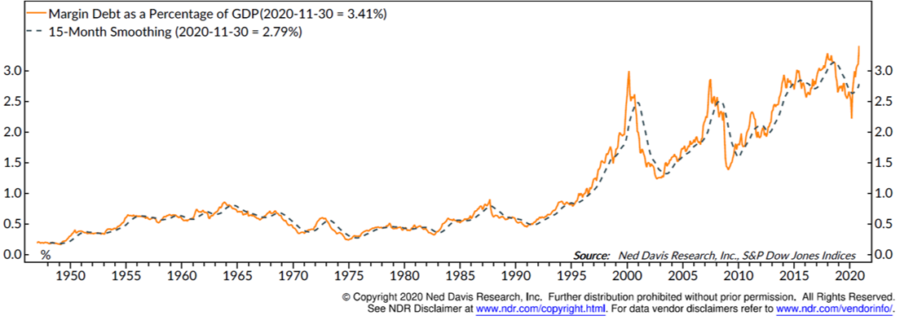

One of the measures signaling high optimism is the amount of margin debt used by investors relative to the size of the economy, as shown in the chart below, which goes back into the 1940’s. Margin debt is borrowings by investors which are backed by the securities in their investment accounts. Most of the time, these borrowings are used to purchase more securities, which typically makes these investments purchased with leverage become “hot money” that are quickly sold in a market downturn before they can wipe out the value of the underlying collateral. Note that prior peaks came in the late 1990’s and mid 2000’s right before major market declines. The more recent peaks in margin debt have preceded large corrections, but generally not bear markets.

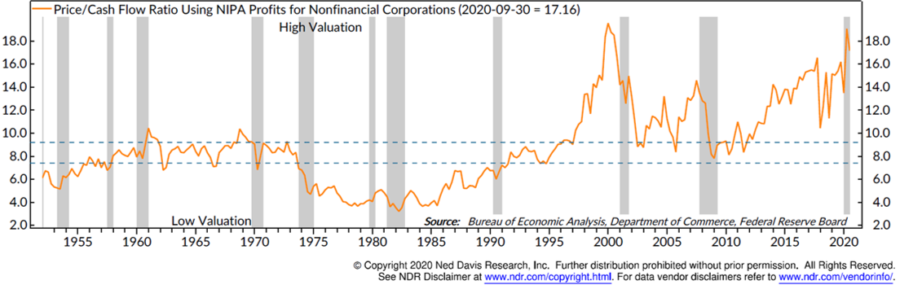

- Valuations are very high

We have been saying that valuations are high for several years, and it begins to sound like a broken record. Yet, the fact remains that they continue to move higher, and valuations are one of the best predictors of long-term returns. There are several measures for valuations. The chart below looks at prices divided by company cash flow, with recessions noted in the gray shading. Outside of the late 1990’s the ratio has never been higher, with the end result being that investors are paying a significant premium to purchase stocks at these levels.

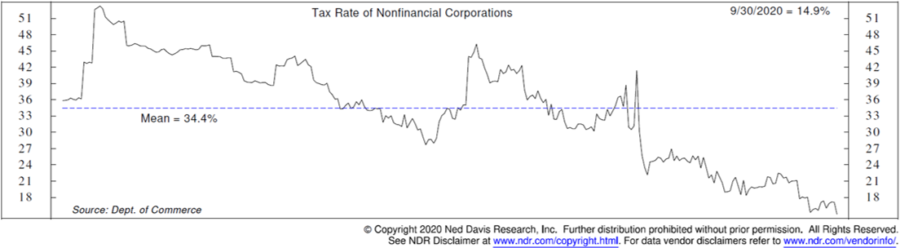

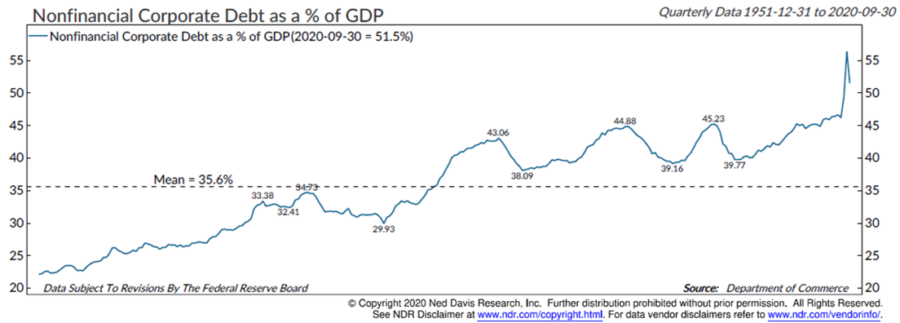

- Debt Service and Taxes on Corporations are Historically Low and likely to reverse

In addition to high valuations, we also have higher than average profitability by corporations, and that is typically a good thing. However, two important significant contributors to the high levels of profitability have been low interest rates and low corporate tax rates. The below, show the historical level of tax rates, and the other chart shows the high level of debt relative to GDP. As the size of the debt grows, or particularly if interest rates rise, this will begin to have an important impact on profitability. If these factors move from being tailwinds to being headwinds in the coming years, it will be increasingly difficult to maintain the high valuations of U.S. stocks.

In Summary

As you can see, there are some solid reasons for either a positive or a negative outlook for stocks in the coming year. In addition, there always seem to be some unexpected developments that occur during the year that will also have a significant influence on whether the return in the markets is positive or negative.

When it comes to our investment process, it is useful to look at factors like the ones previously discussed that can contribute to a positive or negative outcome over a longer-term time frame. However, what is most important to our investment process is our short-term weekly rankings of quantitative factors such as trends and relative strength across domestic and global stock markets, investor sentiment, seasonality, and interest rate trends. We then take the ranking of these indicators and compare them with similar readings over the past 20+ years to determine a risk profile that helps us to shape a real-time expected risk/reward profile that then influences how we set and periodically adjust asset allocations.

If you invest in the financial markets long enough, you will see some very good years, and some very bad years. Our aim is to smooth out the ride, particularly during longer-term sustained declines and provide you with returns that will allow you to reach and maintain your financial goals.

We appreciate the opportunity to work with you, and hope that the year ahead will be good and more normal than 2020.

Michael Ball CFP®

Managing Director

Weatherstone Capital Management, a Transform Wealth, LLC (Transform Wealth) company, is a Registered Investment Adviser with the U.S. Securities and Exchange Commission (SEC). Transform Wealth is a wholly-owned subsidiary of Focus Operating, LLC. which is a wholly-owned subsidiary of Focus LLC. The content is for informational purposes only and does not represent an investment recommendation by Weatherstone Capital Management or Transform Wealth. More information about Weatherstone Capital Management and Transform Wealth, including our investment portfolios, strategies, fees, and objectives can be found in our respective ADV Part 2A Brochures, available upon request.

The opinions expressed are current at the time of publication and subject to change without notice. The manager’s views are subject to change at any time based upon market and other conditions, and no forecast can be guaranteed. This material does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Information contained in the commentary has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed. Past performance does not guarantee future results.