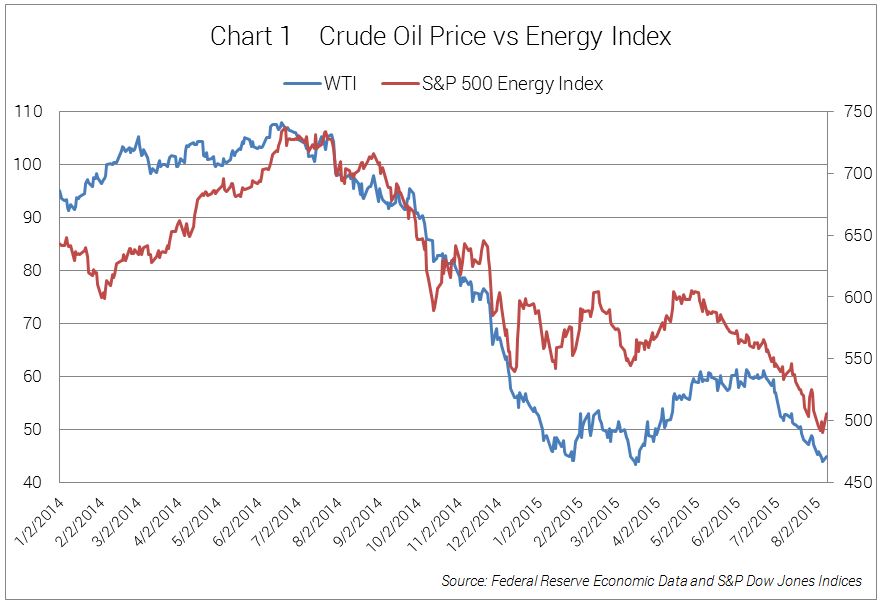

This year has been marked by volatile interest rates thus far making it challenging for income investors and managers alike. The dramatic slump in oil prices since last June has weighed heavily on the energy sector, sending energy stock prices to new lows. As can be seen from Chart 1, the West Texas Intermediate (WTI, a benchmark in oil pricing) first fell below $45 a barrel in January 2015 from more than $100 in June 2014, and now it has fallen below $45 again¹. During the same period, the S&P 500 Energy Index experienced a max drawdown (the biggest peak-to-trough decline) of -33.47%². It might be tempting to think that it is a good timing to own the energy sector at its bottom.

The problem is that it is impossible to forecast the real bottom. The latest example is in March, when the energy sector seemed to have bottomed out. Then we saw it pick up and go down even further. Even though most investors believe oil prices will rebound in the long run, investing in energy may result in embracing more volatility than you would like to tolerate. We believe Master limited partnerships (MLPs) could be an alternative for investors who want energy exposure but less exposure to downward commodity price volatilities.

MLPs are a unique investment vehicle. An MLP has a partnership structure but is traded publicly like common stocks. Most MLPs invest within the energy industry. Some advantages of MLPs include limited commodity price exposure, tax deferral benefits and relatively high yield.

Limited commodity price exposure

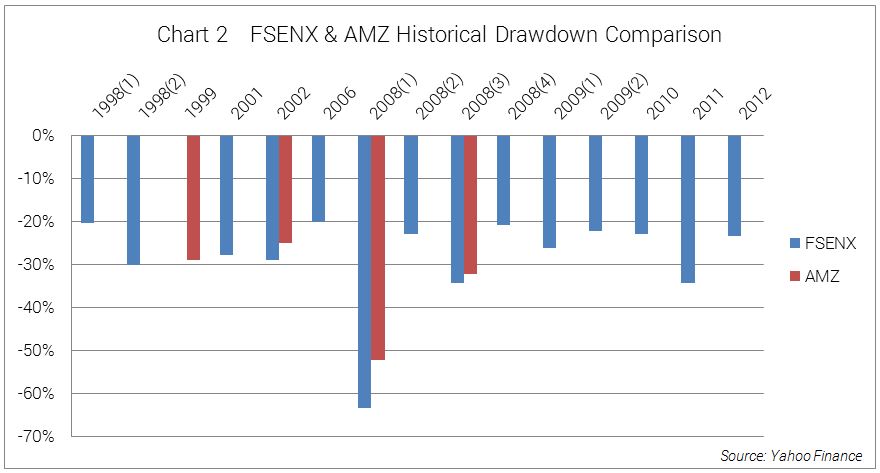

The majority of MLPs are midstream MLPs, which are operators of pipelines and storage facilities focusing on transportation and storage of oil and gas. Midstream operations are often referred to as “toll roads”, because MLPs charge rental fees through long-term contracts. Unlike energy production companies whose revenue relies on oil and gas prices, MLPs are not directly influenced by commodity prices. Even if prices decline, MLPs can still generate stable cash flows. Historically, MLP stocks tend to be less volatile than energy stocks. From 1996 to 2013, the Fidelity Select Energy Portfolio (FSENX) experienced a more than 20% drawdown 14 times, while the Alerian MLP Index, (AMZ, a benchmark for MLPs) experienced only four such declines and tended to have smaller drawdowns. Chart 2 shows the historical drawdown comparison.

Tax advantage

Even though MLPs are traded like common stocks and have the same liquidity, they avoid the double taxation on traditional corporations—paying taxes first at the corporate level, and then paying taxes again at the individual level when shareholders receive dividends. Like other limited partnerships, MLPs do not pay corporate income tax. They pass through earnings directly to investors as distributions. Unlike dividends, 80% to 90% of the distributions are not taxed when received. Those distributions are considered a return of capital and subtracted from the cost basis of the initial MLP investment. The tax liability on the distribution is deferred until the MLP is sold to incur a capital gain.

For example, assume you buy an MLP at $100 a unit. One year later, you receive $6 in cash distributions. Assuming the taxable portion is $1, the remaining $5 is tax deferred and considered a reduction of cost basis. If you hold the MLP for several years, every year you can get cash distributions and this actually creates a relatively high income stream.

High yield

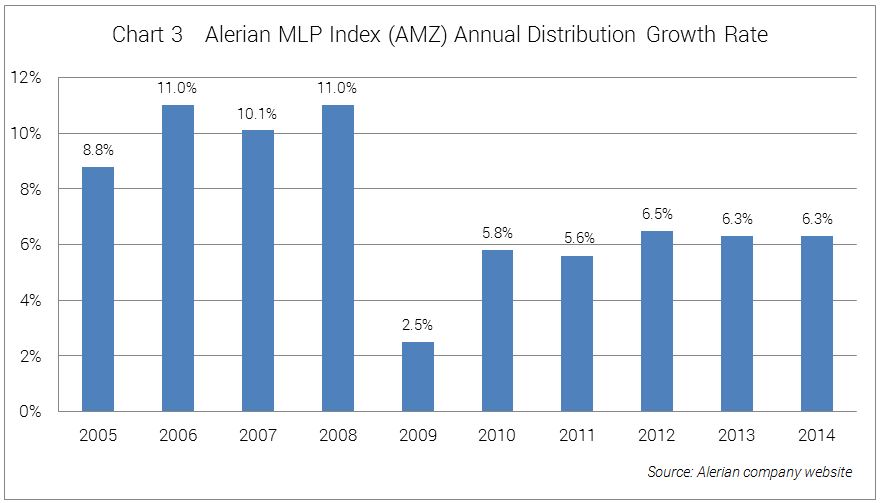

The stable revenue due to the “toll road” business model and tax benefits due to the partnership allows MLPs to pay out significant quarterly distributions. Most MLPs offer a yield of 6% to 7%³. MLPs also have a high distribution growth rate. Chart 3 shows the annual distribution growth for the past ten years4. The average growth rate is 7.4%. That is why MLPs attract a large number of income-oriented investors, who tend to hold investments for a long time rather than speculate for short term capital gains. In fact, the tax deferral benefits work better in the long run, because investors have more time to compound the tax-deferred income and generate returns that may be more than the eventual tax.

Since early 2015, interest rates have been trending higher for most areas of fixed income. This has made for a very difficult environment to find good, profitable investments within the fixed income space. As we have evaluated both the fixed income and equity income investment options available to us during this time we feel that the energy MLPs have become quite attractive after their decline over the past year based upon historical valuations and relative yield and growth prospects vs. other competing investments. We have begun accumulating positions in this asset class in several of our portfolios, and although we have seen and expect to continue seeing above-average volatility in this asset class until energy prices settle down, we feel that the long-term reward potential is very attractive over the next several years for income-oriented investors.

Daisy Ma

Investment Analyst

Sources & Disclosure

1) Federal Reserve Economic Data 2) S&P Dow Jones Indices 3) Alerian company website 4) Alerian company website

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. The S&P 500 Energy Index comprises those companies included in the S&P 500 that re classified as members of the GICS energy sector. The S&P 500 Index is an unmanaged market capitalization weighted price index composed of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and Over-The-Counter market. Indexes are provided exclusively for comparison purposes only and to provide general information regarding financial markets. These indices or funds referenced in the article should not be used as a comparison of managed accounts or suitability of investor’s current investment strategies. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. The value of the index varies with the aggregate value of the common equity of each of the 500 companies. The S&P 500 cannot be purchased directly by investors. This index represents asset types which are subject to risk, including loss of principal. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part 2 document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.