- The high-risk macro backdrop for the economy was a primary reason our portfolios were quite conservative as we began the year

- Many foreign markets are less expensive on a historical valuation basis than the U.S.

- As we move through 2013, bond portfolios may experience increased risk

With 2012 now in the books, I wanted to discuss some of the important macro events that shaped the past year and highlight a couple of the important risks and opportunities that are shaping up for 2013 in regard to the financial markets. As we moved into 2012 there was significant cause for concern about the possibility of a 2008 style financial crisis in Europe. Renewed economic weakness in the Eurozone, combined with an unwillingness of investors to buy the bonds of banks or economically vulnerable countries such as Italy, Spain, Ireland and Greece caused interest rates to rise to levels considered to be fiscally unsustainable. In addition, levels of risk in European banks based upon bond credit default swaps, was reaching levels not seen since the 2008 financial crisis.

This high-risk macro backdrop for the economy after the historically strong market advance of 2009-2010 was a primary reason our portfolios were quite conservative as we began the year. The stock market moved strongly higher during the first quarter of the year on the belief that the worst was over for Europe based upon the pledges of Central Bankers to provide enough liquidity and other stimulus to keep the credit markets in Europe from freezing up as happened in 2008. The historical track record of Central Bankers effectively navigating through important financial crises is quite mixed. However, in this case, the impact of the action began to bring down some of the risk measures that we tracked for the European bond markets, but we did not increase our equity exposure significantly due to an increasing amount of economic evidence that the economy both domestically and abroad was weakening once again. We discussed some of the problems that we were seeing in our April and July commentary which can be found in the respective quarterly statements.

The result was that despite a strong rally in the first quarter of the year, economic worries caused much of the advance to be given back during the second quarter, during which our conservative positioning helped prevent much of the decline in the managed portfolios. As we went through the second half of the year we began to increase equity exposure incrementally as economic softness began to stabilize and money began to move back into the equity markets. We were particularly pleased to see renewed strength from foreign markets during the fourth quarter after they had underperformed for nearly 2.5 years. This strength resulted in significant increases in our equity exposure during the last couple of months of the year, and helped virtually all of our equity portfolios outperform the major U.S. indexes during the 4th quarter of the year.

For the year, I was disappointed that our portfolios lagged the major market indexes, but the financial environment in Europe which we were faced with early in the year had many similarities to the problems that we faced in our own financial system in 2007-2008. Had there been missteps, the European markets could have had a crisis as large as or larger than ours, and our financial markets would have almost certainly been pulled down significantly because of their problems. Prudent risk management is not about seeing the future and knowing if a situation will turn out badly if the odds are not in your favor; it is about recognizing that the odds are not in your favor and staying away from the risk until things improve. A person may be lucky once in a while, but long-term they will do poorly. It is typically better to stay with the average outlook and not get too caught up in any one episode. As we have moved through late 2012 and into early 2013 our portfolios have been well positioned to avoid much of the volatility surrounding the fiscal cliff debate and to benefit from the market advance of early 2013.

Other noteworthy developments during the year was a shift from housing being a drag on the economy for the past several years, to now being a modest positive, as sales of new and existing homes picked up compared to the prior year, and as the Case/Schiller home price index ended the year with 9 consecutive months of increasing homes values compared to the prior year.

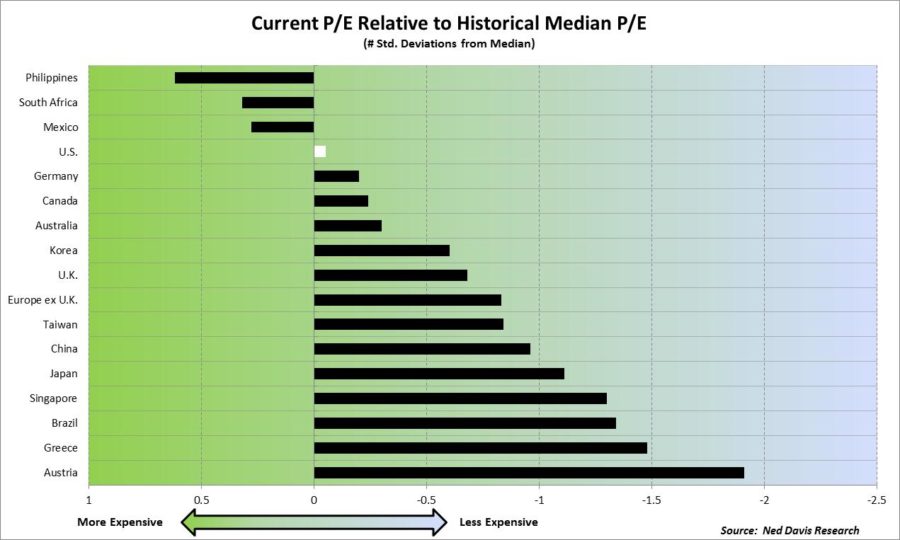

I mentioned earlier that international markets have spent most of the time since 2010 being weaker than the United States. As a result, many foreign markets are less expensive on a historical valuation basis than the United States, as shown on the chart below.

If we can see continued stability from Europe and China then it is quite likely that we will see foreign markets outperform the United States over the next year or two as foreign valuations move back to historically normal levels. However, it is likely that the path back to more normal valuations will be bumpy as noted by German Chancellor Angela Merkel who recently remarked that even though reform measures designed to address the roots of the problem are beginning to bear fruit, the crisis is far from over.

One of the challenges that may become more significant as we move through 2013 is increasing risk in bond portfolios. Over the past couple of years virtually any area of the bond market has produced positive returns. Yet if we see the trend of interest rates move from trending lower to trending higher, we could see that begin to erode the value of some types of bonds and government bonds in particular. Adjustable rate bonds, as well as areas such as high yield corporate bonds that are more economically sensitive are an example of two areas that can outperform in rising rate environments.

As we move into 2013 I am pleased to say that it appears that for the first time since the end of 2009 the outlook for the economy at the end of 2012 was more positive than when we started the year. If we have a more stable economic environment, we are likely to see significant flows of money between asset classes and that could open up some good opportunities if we position the portfolios well. The risk for volatility remains above-average, but the level has come down from where we have been over the past couple of years. We will remain vigilant regarding portfolio risks and make adjustments as necessary. We appreciate the confidence that you place in us and wish you a good 2013.

Michael Ball

Lead Portfolio Manager

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. Foreign investments are subject to risks including political and economic instability, inflation, deflation or currency devaluation and government limitations. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.