It’s been two years of relative calm across the European Union (EU) following years of political turmoil, debt crises, and protests that pushed the EU to the brink of collapse. Many economic reforms have been enacted since the peak of the European debt crisis in 2012, including relaxing deficit-reduction requirements and increasing monetary stimulus measures. Although these reforms brought about stabilization to European financial markets there is still a long way to go to reduce unemployment, accelerate economic growth, and ignite inflation throughout the EU.

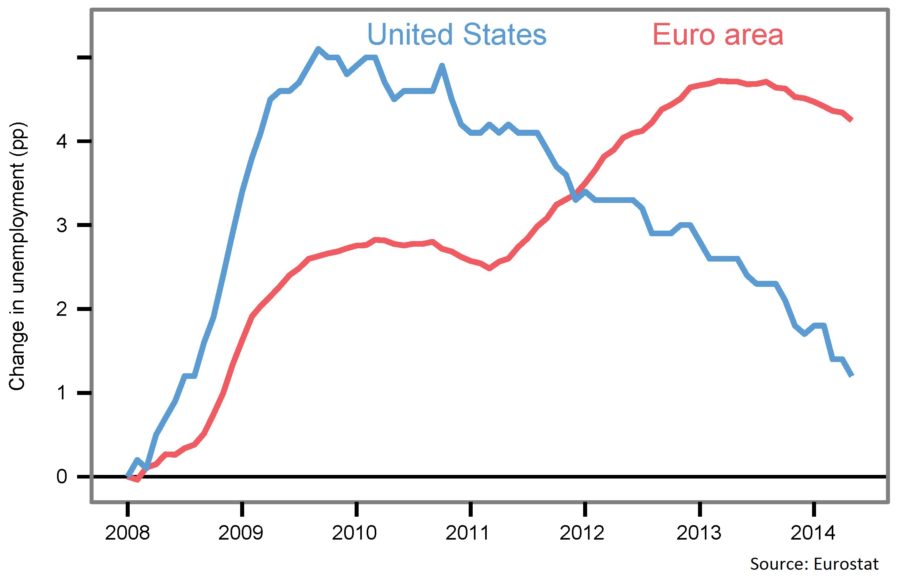

The euro area currently has 18 member countries within the EU who have all adopted the euro dollar (euro) as their currency. Together, the euro area accounts for roughly 20% of the global economy, making the state of their economic affairs a top concern for global investors (1). The EU’s biggest challenge continues to be stubbornly high unemployment. Mario Draghi, the head of European’s Central Bank (ECB) stated in his August 22nd speech at the Federal Reserve’s annual symposium in Jackson Hole, Wyoming that “Unemployment is at the heart of the macro dynamics that shape short and medium-term inflation.” (2) He showed a version of the chart below during his speech which shows the change in the unemployment rate since the end of 2007. After the unemployment rate in the U.S. reached a peak of 10% in 2009 following the financial crisis, it steadily fell and now stands at just over 6%. You can see that we are near our pre-crisis level. This compares to a euro area unemployment rate of 11.5%, which is still near its 2013 high of 12%.

There are many challenges facing the EU’s unemployment conundrum, one of which is the disparity of unemployment across the member countries. The unemployment rate currently ranges from roughly 25% in troubled countries such as Spain and Greece to as low as 5% in Germany, Europe’s largest economy (3). Many economists point to labor laws within Europe as one of the primary culprits to the disparity across European countries and to the high unemployment rate. For example, French labor laws make it difficult to fire someone who is on a permanent contract which makes hiring a new employee a difficult decision for an employer. In addition, France has the third highest minimum wage rate which also hinders employment and makes it difficult for French companies to compete globally (4). Extended periods of high unemployment can have numerous consequences on an economy. These consequences can include low inflation or deflation and low or declining economic growth, both of which the EU is currently facing.

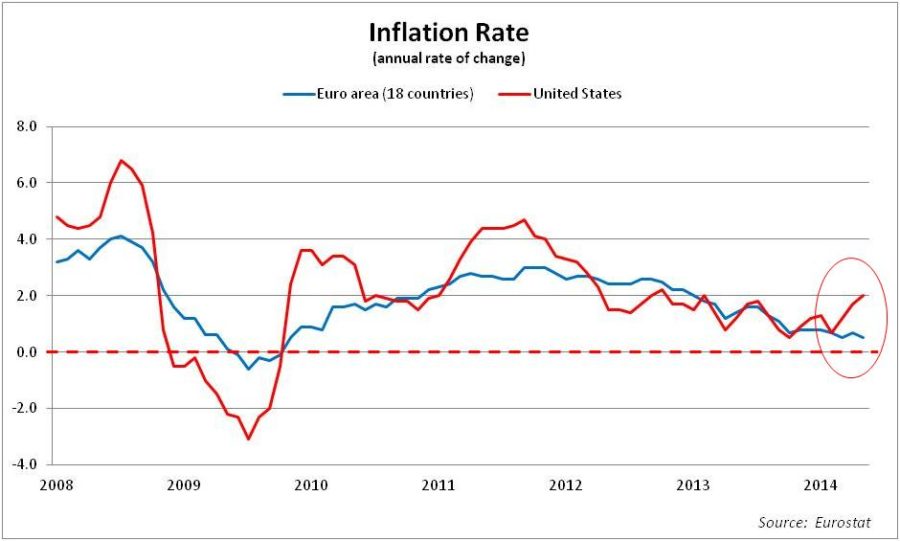

Annual inflation within the euro area currently stands at .3% a far cry from their target of 2% and roughly the current rate of U.S. inflation (4). The biggest risk of low inflation is slipping into outright deflation which can be detrimental to an economy on a number of fronts. One cause for concern is consumers delaying purchases because of expectations that prices will continue to move lower, further weakening the economy. As the chart showed above, the euro area is at risk of deflation and persistent high unemployment leaves far fewer citizens contributing to economic growth. However, the U.S. showed what aggressive monetary stimulus has the potential to do when used to restore a fragile economy.

Although many economists and financial experts have stated that the ECB has done too little too late, it will be stepping up its monetary stimulus very soon. The stimulus will be similar to that of the U.S. and its quantitative easing (QE) programs. The ECB announced in early September that it will begin quantitative easing (QE) to the tune of nearly $1 trillion in asset purchases (5). As a comparison, the U.S. started QE with its first round of $1.5 trillion and once all is said and done should be all-in for around $3.7 trillion in assets purchased (6). Over the course of the U.S. QE programs, unemployment went from troubling high levels to almost the natural rate of unemployment, a housing market restored to pre-crisis price levels, and a stock market that is on one of its longest bull market runs in history.

A big question in the back of investors’ minds is whether quantitative easing in the EU can have the same success as the U.S. A key component to the ECB’s stimulus success will be a devaluing of the euro which has already began to unfold. The euro has declined by 6% against the U.S. dollar since the first of the year and investors are continuing to place bearish bets on the currency (7). As a result, European exporting countries should benefit and investors should be leery of investing in European investments denominated in euro. We will continue to monitor the developments across the EU as additional stimulus is implemented and will be looking for investment opportunities along the way.

Luke Nagell

Investment Committee Member

Sources & Disclosure:

1) http://www.tradingeconomics.com/euro-area/gdp

2) http://www.bloomberg.com/news/2014-08-29/euro-area-inflation-slows-as-draghi-hints-at-more-ecb-stimulus.html

3) Eurostat

4) http://www.bloomberg.com/visual-data/best-and-worst/highest-minimum-wage-countries

5) http://www.bloomberg.com/news/2014-09-04/draghi-sees-almost-1-trillion-stimulus-with-no-qe-fight.html

6) http://money.cnn.com/2013/10/28/news/economy/federal-reserve-qe-stimulus/

(7) http://www.bloomberg.com/quote/EURUSD:CUR

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.