This past week the stock market, as measured by the S&P 500, wrapped up its best January performance since 1997, up 5.6%. It was also its worst weekly performance in two years, with the S&P 500 down 3.85%. Many investors are wondering what is going on with the market, and is this something that we should be worried about?

First, let’s keep in mind the fact that the stock market has been going through a period of exceptionally low volatility. We have just wrapped up the longest stretch without a 3% correction, since data on the S&P 500 has been calculated back to the late 1920’s, and are in the longest period without a 5% correction since the 1950’s. Additionally, with the strong start to the year, the weakness we have seen in late January and the first couple of days in February dropped us all the way back to where we were…three weeks ago.

With that being said, we don’t take stock market risk lightly because we know that market declines can have a significant negative impact on an investors ability to reach their financial goals. So, let’s look at the current decline with some additional context.

The primary factor cited in the decline this week is the jump that we have seen in interest rates as investors increasingly feel that the Federal Reserve may need to raise interest rates more than expected due to an accelerating economic growth rate after the recent tax cuts here in the U.S., and rising input and output price pressures that are now at their highest level since 2011, in the most recent global Purchasing Managers Index that was reported this week.

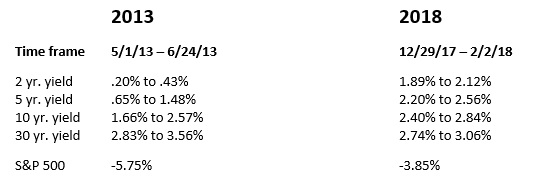

Since the beginning of the year, interest rates have moved up by nearly 50 basis points, or 1/2 of 1% on 10 year U.S. Government bonds. We had a similar jump in interest rates back in 2013 that was even larger. The jump occurred because the Federal Reserve announced that they were planning to begin winding down their program of buying bonds to stimulate the economy, frequently referred to as Quantitative Easing. The interest rate increases that occurred in 2013, and the resulting selloff in the stock market in comparison to the current jump in rates and the market selloff are as follows:

As can be noted from the table above, the jump in yields back in 2013 was quite a bit larger than is has been so far in 2018, but the stock market decline was only about 2% deeper. In regard to why the stock market selloff is nearly as deep as the 2013 decline with a smaller increase in bond yields could be due to the extended stock market advance that we have seen since late 2016. This pause may be giving people reason to lock in some of the profits that they have made over the past couple years. It could also be due in part to the rising expectation that the magnitude of the interest rate changes may eventually be larger than we saw in 2013. This could be due to the expectation that the Federal Reserve will raise interest rates three times this year, with a moderate probability that we will see four increases if inflation pressures are higher than expected.

If we look at other recent stock market declines that were triggered by investor concerns, we can look back to the brief but very sharp stock market selloff that occurred at the time of the U.K.’s Brexit vote, in which the stock market lost 5.3% over two days, or in October of 2016, when the stock market lost 3.1% in the weeks leading up to the presidential election. In each case, the increase in uncertainty caused uncomfortable stock market selloffs, and in each case stocks rebounded in the coming weeks as the focus of most investors returned to the larger picture of reasonable economic growth, and the realization that it was not likely to be derailed by the current event, and the context of interest rates that were still very low by historical standards.

My belief is that we find ourselves in a similar situation, where the realization that rates may move up more than expected is pressuring stocks, but with continued robust economic growth, and earnings that are currently projected to grow by nearly 20% in 2018, this may soon settle down the stock markets. However, while the historical context suggests that this selloff may soon return to a market rally, we rely much more heavily on our short-term risk measurement models to make the determination of whether we need to be playing offense or defense. Currently those models remain positive for stocks, so we remain owners of stocks in our growth-oriented investment strategies. In our Weatherstone managed Income and absolute return strategies, we did reduce exposure investments that can be impacted by a declining stock and bond market, and parked the money in cash or moved those proceeds to short-term bonds.

We believe that successful investing is built upon prudent risk management and regularly monitoring whether the potential return is worth the risk that we need to take to get that return. It currently appears that the risk that we are entering a new bear market is low, but we will continue to monitor the situation closely and make adjustments as needed.

Michael Ball

Lead Portfolio Manager

Some of the statements made in the commentary are not purely historical and may be forward looking statements regarding our intentions, projections and strategies for the future, and are subject to change at any time without notice. Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, and securities or instruments or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal.