- The latest Chinese property curbs released on March 1st, 2013 are considered to be the strongest of so far.

- From 1997 to 2012, urban average housing price per square meter increased 193% while disposable income per capita increased 376%.

- Chinese property companies confidence is at a three-year high and half of the property companies are planning to raise housing prices in the third quarter.

If there were a “Chinese dream,” the symbol of it would be undoubtedly housing—a decent (apartment) home in a city. For the past 10 years, China’s housing prices have surged, making the Chinese dream harder to accomplish. In order to make housing more affordable, the Chinese government has implemented a series of regulatory measures to cool down the residential real estate market since 2003. The latest Chinese property curbs released on March 1st 2013, considered the strongest so far, included a 20% tax on capital gains from second home sales and higher down payments and mortgage rates on second homes. On the following business day, share prices of Chinese real estate developers slumped and the Shanghai Stock Exchange Composite Index went down 3.65%. The markets reaction illustrated investors’ concerns that the Chinese housing bubble was about to burst. The recent televised CBS 60 Minutes covered Chinese ghost cities, which are considered a symbol of the housing bubble. However, this commentary will illustrate that a housing bubble might not exist, let alone a housing market crash.

For those housing bubble believers, the burst of a bubble has scary consequences. If property prices were to plummet, China’s real estate markets would experience severe negative consequences. The banking system would have extensive bad debt from developers and local governments. Due to the importance of the real estate sector within the Chinese economy, it would slow down China’s Gross Domestic Product (GDP) growth. The reduced demand for construction related products such as steel and copper as well as the reduced purchasing power of Chinese people would make the recession ripple across the global economy. Many people are concerned this outcome could lead to a financial crisis similar to the U.S. in 2008.

So, is the next financial crisis coming? There is evidence to the contrary. According to the National Bureau of Statistics of China, from April to June, new housing prices have risen in general. The latest June data shows new housing prices increased in 63 cities among 70 medium and big cities compared with the previous month and increased in 69 cities compared with a year earlier , a sign that the housing market is still strong.

Now, let’s look at why housing prices are so high. There are two types of demand that have been pushing up prices for years: speculative demand and consumer demand. Speculators buy apartments not for residence purpose, but for flipping them to gain from price appreciation. Bearish analysts (those who believe prices will decline) maintain that many speculators hold 10 or even 20 apartments, making the housing price bubble bigger and bigger. If it bursts, speculators will dump apartments, causing economic turmoil. However, no one knows the exact number of, or how many of them are left after the Chinese government’s efforts to crack down on property speculation since 2010. Due to those regulatory measures, the housing market cooled down from the third quarter of 2010 until mid-2012. For example, in December 2011, among 70 medium and large cities, new housing prices declined in 52 cities and remained the same in 16 cities compared with the previous month . Maybe speculation cannot be squeezed out completely right now, but consumer demand has played a greater and greater role in housing price appreciation, contributing to strengthening the housing market since mid-2012.

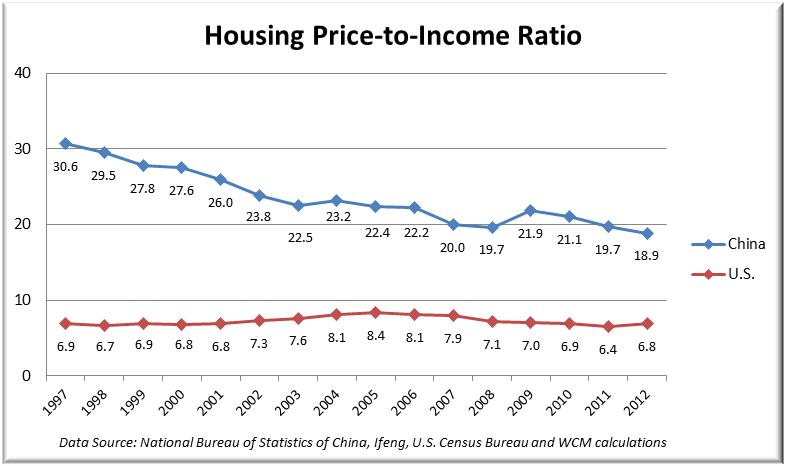

Consumer demand is supported in part by increased income. From 1997 to 2012, urban average housing price per square meter increased 193% from 1977 to 5791 yuan. At the same time, urban annual disposable income per capita increased 376% from 5160 to 24565 yuan . Combining the two data series and assuming an average home of 80 square meters (861 square feet), we can compute average urban housing price-to-income ratio for the past 15 years as shown in the chart below.

While the Chinese government has been criticized over declining housing affordability, it may be surprising to see that housing price-to-income ratio trended downward for the past 15 years. Meanwhile, the U.S. housing price-to-income ratio has been around seven. Some people may point out that with an average housing price-to-income ratio of 19, housing is still very expensive despite the climbing income. Let’s go back to the “Chinese dream” I mentioned at the beginning of this commentary: “a decent home in a city.”

The first key word is “home.” Chinese people have a long-ingrained perception that a decent home is a necessity for a desirable family. They are aware that housing is probably the most expensive asset in their life, but are still willing to pay for it. This is especially the case for young men who want to get married, since most people believe “no housing, no wife.” Thus young people often get money from parents and maybe borrow money from relatives to buy a home. Behind one home, there may be the financial savings of several generations. Again, they are willing to pay for it. You might want to ask why they do not consider mortgages. Actually some people do. With the down payment of 30% for the first home and 60% for the second one (in the U.S. the average down payment is 16.1% for the first home and 32% for the second one ), many young people still cannot afford it without family support. Besides, Chinese are savers and are reluctant to live with debt. That is why many people tend to pay in cash or end the mortgage debt as soon as possible. Large down payments and reluctance to take mortgages would make it hard to form a mortgage debt bubble.

Another key word is “city.” Due to the huge inequality gap of urban and rural areas, every year more than 10 million people moved to cities from rural areas. At the end of 2012, the Chinese urbanization ratio was 52.6% , still much lower than that of many developed countries. With the Chinese government’s continued urbanization policy, the urbanization ratio has the potential to rise for at least another decade. The increasing urban population will generate more consumer demand.

As a result, increased consumer demand backed by income growth and willingness to fulfill the Chinese dream continues to support the increasing housing prices and questions the validity of a housing price bubble. However, there are problems in the housing market, mostly on the supply side. Since land belongs to the government, local governments are eager to sell land for construction to increase fiscal revenue and local GDP. Developers are happy with bank loans or shadow banking financing (financing through off-balance-sheet trust and wealth management products) provided to local governments, without thoroughly considering the feasibility of the new properties. The conspiracy of local governments and developers leads to irrational construction planning and over-building, and in worst case scenarios, “ghost cities” (quite limited and not as prevalent as some media outlets report).

The ineffective housing supply not only fails to meet the increasing demand, but also poses risks in the shadow banking system, as a large number of property projects financed through shadow banking avoid regulations on bank lending. According to Moody’s estimates, Chinese shadow banking products amounted 29 trillion yuan ($4.7 trillion) at the end of 2012, which was 55% of GDP (In 2007 U.S. real estate boom, total mortgages were 105% of U.S. GDP ). Although there is no immediate threat of a meltdown, the central bank has already tightened credit to rein in the shadow banking system . Although manufacturing activity has slowed even further due to rising interest rates, the short-term economic pain would be much better than a potential credit crisis.

Implemented for four months, the latest property curbs have raised doubts on their effectiveness. The 20% capital gains tax is criticized for driving housing prices even higher, though unintentionally, because it is actually imposed on the buyer in this seller’s market. Another criticism is the 20% capital gains tax on the second home policy “encourages” couples to divorce (and remarry later, hopefully) to make the second home only one home for one of the ex-couple, circumventing the tax. However, the Chinese government may issue increasingly strict policies such as a property tax if housing prices continue to climb. This shows its determination to further squeeze out speculation and reduce housing prices to make housing more affordable to citizens, or in my words, to make more people’s “Chinese dream” come true.

As a result, it is doubtful that a real estate market collapse on the way. Chinese property companies’ confidence is at a three-year high and more than half of the property companies are planning to raise housing prices in the third quarter. While it is unreasonable to reduce housing demand, the Chinese central government may want to intervene in residential property planning and construction, increasing effective supply of homes that meet people’s needs at different income levels. Along with the increasing residential demand, the Chinese housing market will have healthier development while decreasing the likelihood of a Chinese housing bubble.

Daisy (Xiaoyu) Ma

Analyst

Sources:

1 http://online.wsj.com/article/SB10001424127887324178904578338990950791724.html 2 National Bureau of Statistics of China 3 National Bureau of Statistics of China 4 National Bureau of Statistics of China, Ifeng 5 http://www.globalpropertyguide.com/Asia/china/Price-History 6 http://online.wsj.com/article/SB10001424127887323469804578525702159384688.html 7 http://www.smartasset.com/blog/housing/weighing-the-options-on-second-home-mortgages 8 National Bureau of Statistics of China 9 http://www.bloomberg.com/news/2013-05-13/china-shadow-banking-poses-systemic-risks-to-banks-moody-s-says.html 10 http://ricardo.ecn.wfu.edu/~cottrell/ecn272/mortgage_data.pdf http://www.bea.gov/newsreleases/national/gdp/2009/pdf/gdp408f.pdf 11 http://www.forbes.com/sites/afontevecchia/2013/06/20/chinas-central-bank-is-engineering-a-liquidity-crunch-to-tackle-the-shadow-banking-system 12 http://www.chinadaily.com.cn/bizchina/2013-07/30/content_16853287.htm

Disclosure: Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.