- Macroeconomic Indicators Signaling a Stall for the Global Economy

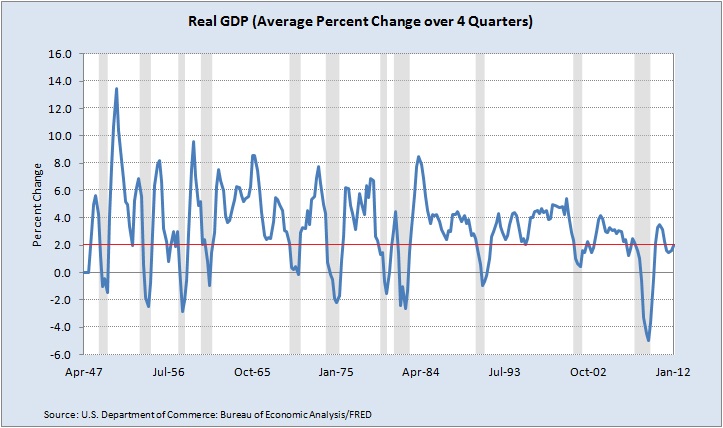

- 70% Chance of Recession When Rolling Four Quarter GDP Drops Below 2%

- Limited Ability of Central Banks to Use Traditional Measures to Stimulate Economies

Imagine if you were on a trip flying in an airplane and the engines suddenly quit. Although the plane is still making forward progress it has become uncomfortably quiet and you are beginning to descend. You know that if the engines are not restarted soon that there could be disastrous consequences. The pilot comes on the PA system and announces that yes, there is a temporary problem and that the engines have stalled, but that this is something that they are trained to deal with and that there is no need for concern.

This airplane story is an appropriate analogy for what we are seeing economically at this time. The economy has been slowing once again, with both Gross Domestic Product (GDP) and employment growth slowing back to dangerously low levels and Central Bankers around the world are discussing ways to stimulate growth. As we discussed in our last quarterly commentary, the risk of a Lehman style liquidity crisis in Europe has decreased, but the chance of seeing a new recession in Europe is quite high. The risk is increasing in the United States as well and recently released data over the past three months has done little to alleviate this concern. Based upon these continuing developments, I feel that it is important to look at where we stand and whether we will be able to pull out of this economic stall or not. This is important because historically the worst stock market declines have typically occurred in conjunction with a recession.

The chart below looks at “stall speed” for the economy based upon research done by Jeremy Nalewaik of the Federal Reserve Board which found that since 1947, when economic growth as measured by GDP drops below 2% over the past two rolling quarters, the probability of recession is 48% within the next year(1) . In addition, if the four rolling quarter growth rate of GDP drops below 2% then the probability of a recession during the next year jumps to 70%. As you can see from the chart below, the four quarter growth rate dropped below 2% late last year and then began to rise. However, a slowing economy makes it unlikely that we will accelerate from the 1.9% annualized growth rate that we saw in the 1st quarter of the year and we will fall back below 2%, which would be a similar pattern to 2008.

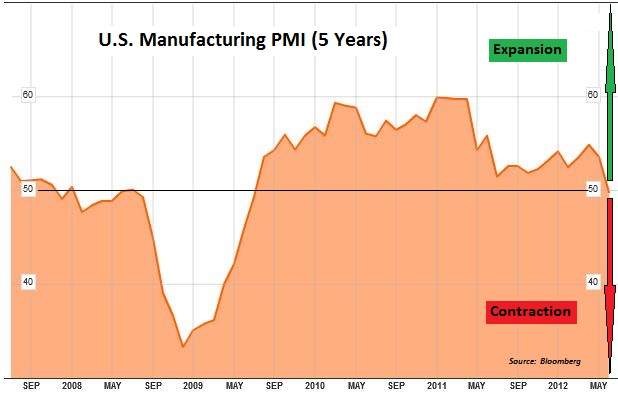

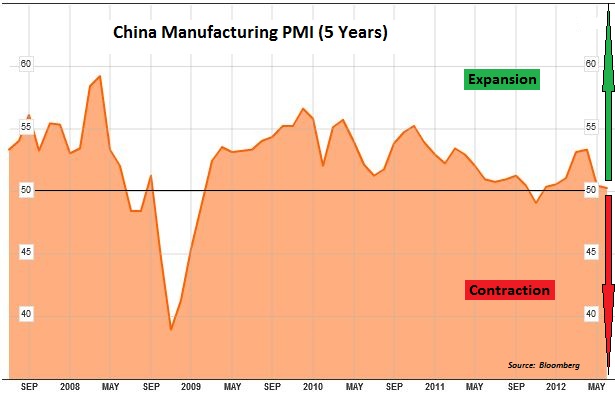

If we look at some of the charts that we have highlighted in the past few months, it is quite apparent that the economy has continued to weaken both domestically and abroad. While this is a negative development in many different contexts, one positive by-product is that the economic data has not weakened as much in the United States as it has in other areas of the world, which has helped our financial markets hold up better than most others. It also makes our country and economy look more attractive than others in terms of places for foreign investment.

One of the biggest negatives to the continued economic weakness is the limited ability of Central Banks from around the world to use traditional measures such as reduced interest rates to stimulate the economy. With short-term interest rates near zero in many countries, Central Bankers are looking at non-traditional policy measures that can help to stimulate their economies. Based upon both our experience domestically as well as from looking at Japan’s experience over the past twenty years, each succeeding round of non-traditional easing seems to have a decreasing impact on the economy. In some ways it is similar to a doctor prescribing an experimental drug where the side effects are not well known or understood, and there is a higher probability of unintended economic consequences which we will need to monitor closely.

When we looked at how all of this has impacted the performance of the stock market during the past quarter, we saw the rally which began late last year run out of steam and the stock market declined by roughly 10% before rebounding somewhat in June, but still ending a few percentage points lower for the quarter. Our conservative allocations and hedging minimized much of the volatility during the quarter. The primary cause of the decline appeared to be the renewed economic weakness and election concerns in Europe. As the level of pessimism among investors increased and stability began to return to the financial markets in June, it appeared that the slowing economic growth had been priced into the financial markets. At the same time the stock market was becoming more focused on the tendency of stocks to perform well in the second half of an election year. As such, we have eliminated our hedging positions (hedge positions are used to protect the portfolio from a declining market) and have added selectively to our holdings, but still remain reasonably conservative in our allocations. If economic growth rates do not deteriorate further, then we will likely see the market follow its historical tendencies. However, if we see continued deterioration in the economy, it could easily override those historical tendencies, just as we saw in 2007 leading up to the 2008 recession.

In summary, it appears that we are moving closer to entering a recession here in the United States, and that some of that has been priced into the financial markets, and they have begun to stabilize. But if we see continued erosion of economic activity we will be in a situation much like that seen in Japan where stagnant economic growth and a Central Bank out of bullets has made for a very challenging environment for investors to make money in equities, unless they were willing to buy equities at certain times, and then were willing to sell and wait for another lower-risk buying opportunity. The next few months will be like being on that airplane and waiting for the engines to turn back on. If they do, then equities will become more attractive. If the engines do not turn back on, then despite their low rates, bonds will be the more attractive place to allocate money until stocks have reached a lower valuation level that reflects the recessionary economic environment.

Michael Ball

Lead Portfolio Manager

Sources: (1) http://www.federalreserve.gov/pubs/feds/2011/201124/index.html

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.