- Continued Eurozone Dysfunction and a Potential U.S. Fiscal Cliff

- Lower Chinese Exports and a Global Economy Teetering on Contraction

- Negative Sovereign Debt Yields have Investor’s Paying for Perceived Safe Havens

Fittingly, déjà vu is a French term meaning “already seen.” It is the experience of thinking that a new situation had occurred before.

All was quiet on the western front for the first few months of 2012, and on the surface the global economy was on the mend. However, in early May, French and Greek elections threw the Eurozone into disarray. The French ousted the incumbent Nicolas Sarkozy, one of the primary players and architects of the Greece bailout package and elected Francois Hollande, a socialist and opponent to critical austerity measures. Also in May, Greek voters elected to power, a controlling party that opposed the austerity measures tied to the largest sovereign debt restructuring in history. In the end, Greece’s newly appointed political leaders failed to form a government and sent global markets into a frantic mode once again. In addition to Eurozone déjà vu, the U.S. will experience its own déjà vu when the debt ceiling, spending cuts, and tax breaks debate will rear their ugly heads at the end of 2012. This situation has been coined a “fiscal cliff” because of the consequences it holds if the issues are not addressed in a delicate and timely manner. While fiscal policies worldwide take center stage once again, corporate leaders continue to sit on standby with their fingers on the company’s hire button.

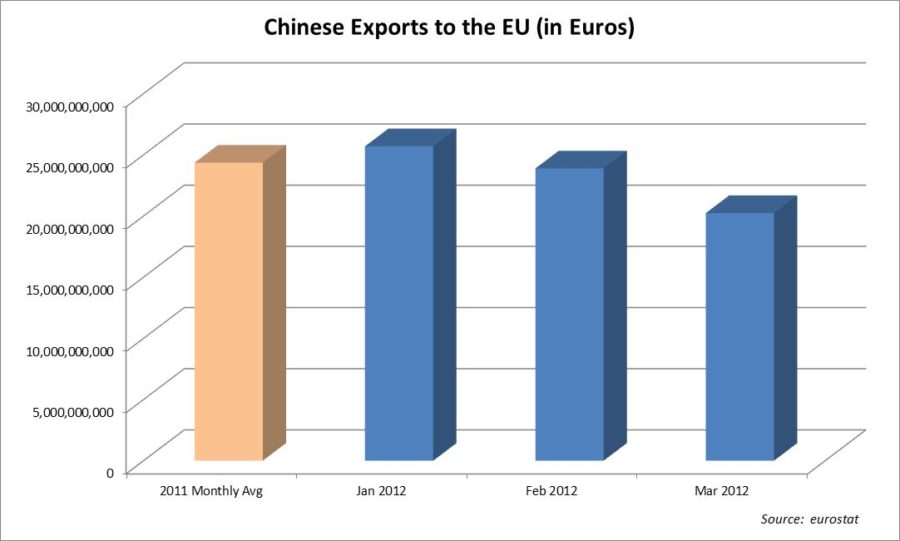

The European debt crisis is beginning to show its impact on large export countries like China. Chinese exports, the current engine of China’s economy, have seen a significant decline over the first three months of 2012 to its second largest customer, Europe. The chart below shows Chinese exports to the European Union (EU) for the first three months of 2012 relative to the average monthly export balance in 2011. Exports in March were 17% lower than the average monthly export balance in 2011(1). In addition to slow global growth, the Eurozone’s currency, the euro is at a 23-month low which is also contributing to a drop in Chinese exports to the EU.

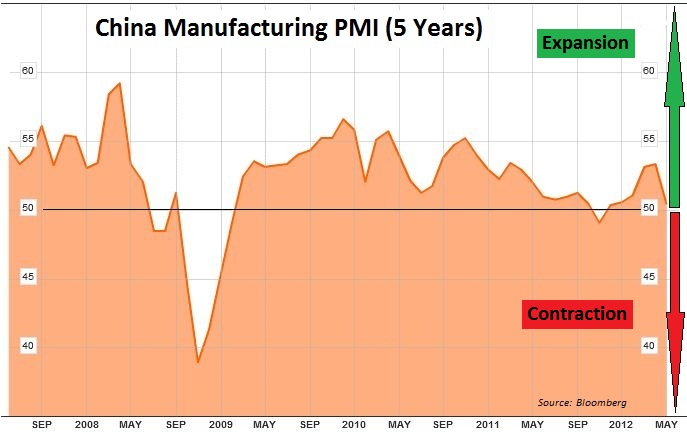

As the euro declines in value relative to other currencies, goods become more expensive for Europeans to import. On the flip side, European goods become less expensive for countries whose currency have appreciated relative to the euro and as a result, will demand more goods from European export firms. Since China’s currency, the Yuan is tied to the U.S. dollar, as the U.S. dollar rises against the euro so does the Yuan. This situation makes Chinese exports more expensive for European’s. The manufacturing sector in China signaled that the slowdown may continue after China reported a lower than expected Performance of Manufacturing Index (PMI) of 50.4 in the last week of May (2).

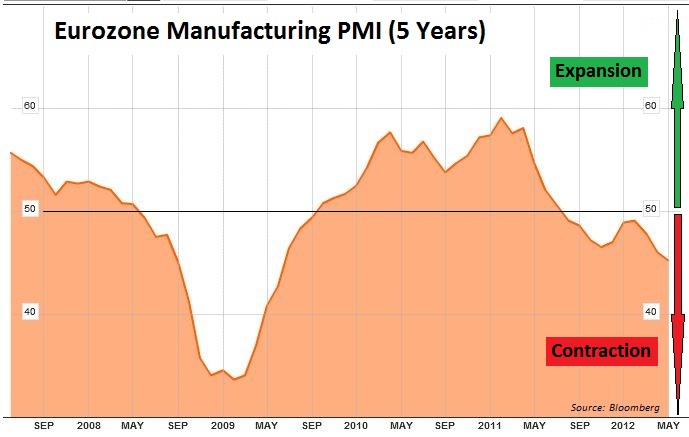

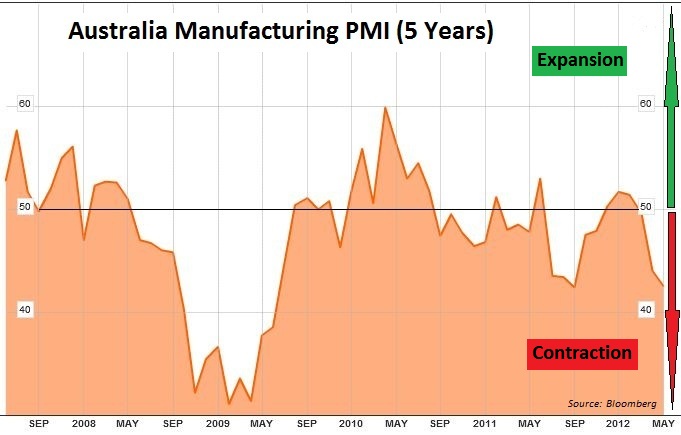

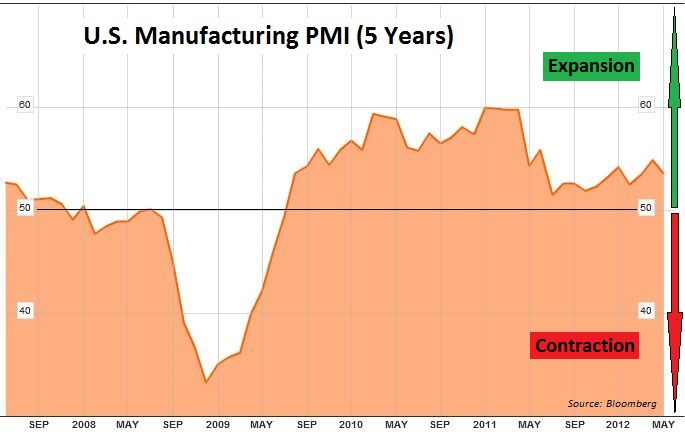

A PMI reading above 50% indicates that the manufacturing industry within the country is generally expanding. A reading below 50% generally indicates a contraction. You can see from the charts below that the Eurozone and Australia PMI indicators are already showing contraction and the U.S. and China are both teetering on contraction.

May’s unemployment report brought shockwaves to the markets when the Department of Labor reported that only 69,000 jobs were created in May compared to consensus estimates of 150,000. This brought the unemployment rate from 8.1% to 8.2% (3). Looking back to the 1980’s when the unemployment rate reached 10.8% it took 58 months or roughly 4.8 years to get back below a 6% unemployment rate. Currently, we are into our 32nd month since the peak unemployment rate of 10% reached in October of 2009 (3). During the 80’s employment recovery, there were nine different times when the unemployment rate increased from one month to the next. The largest increase came in February of 1986 when the unemployment rate increased from 6.7% to 7.2% (3). When severe damage is done to an economy, like seen in 2008, the healing process is slow and can be a bumpy road, like seen in the 80’s employment recovery.

The last week of May 2012 will go down in history. After a lower than expected China PMI and a missed U.S. jobs number, investors flocked to the safety of sovereign debt and drove yields in numerous countries to levels never seen in this global monetary system’s history. Perceived “safe haven” countries in the EU and the U.S. all saw record low yields as investors digested poor economic data and as worry about a Eurozone breakup increased. On June 1st, the ten-year Treasury note closed at an all-time record low of 1.47%. In addition, the yield on the German two-year note reached a negative yield of -0.005% (4). When yields reach levels below the rate of inflation, investors appear to be looking for a return-of-capital instead of a return-on-capital. Furthermore, when yields turn negative, investors are paying to park their cash. It is very clear from the PMI data and other market indicators that the global economy is once again teetering on the verge of a contraction.

The global economy suffered a major head wound in 2008 when the financial crisis began to unfold. Similar to a quarterback receiving a head or a neck injury, the recovery process from a severe crisis is slow and closely monitored before giving the “all clear” status. The political dysfunction within the EU is similar to that of an inadequate physician or father who puts the player back in the game before he is 100% and without any precautionary measures in place. In addition to the EU, the U.S. will need to assess the health of its quarterback as we near our own “fiscal cliff.” The investment team will be closely monitoring the events in Europe and leading economic indicators over the short-term and if needed, will be ready to stack our offensive line to protect the recovering quarterback.

Luke Nagell

Investment Committee Member

Sources: (1) Eurostat (2) Bloomberg.com (3) dol.gov (4) http://online.wsj.com/article/BT-CO-20120601-704103.html

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.