- First Quarter Review

- Model and Economic Indicators

- Continued “Tail Risk”

Investing in higher risk assets has been rewarded as markets moved higher on the belief that Italy, Spain and Portugal would be able to roll over the large amount of bonds that were coming due in February and avoid triggering a Lehman-style liquidity crisis. The government bond auctions did go better than expected, and that coupled with stronger than expected job creation in the United States kept indexes like the S&P 500 moving consistently higher during the first quarter. Although U.S. equity markets performed strongly in the first quarter, we continued to hold a conservative asset allocation throughout (a more in depth review of portfolio performance and allocations can be found with your quarterly statements).

One of the primary background environment models we use for the U.S. stock market looks at three different indicators; how broad-based a market advance or decline is in terms of the number and momentum of industry and sub-industry groups participating, the amount of optimism or pessimism by market participants, and whether we are in a seasonally positive period for stocks or not. The model looks back at nearly 20 years of history for those three items and their interaction. The model then provides an expected return based upon the particular set of conditions. During the first quarter we spent most of the time in an environment where stocks have historically gained at an annualized rate of about 3.5%. This return was below the expected rate of return for most of our bond models. In addition, we reached a significantly high level of optimism from one of our primary sentiment models in early February that has historically been negative for the stock market over the next several weeks. That also influenced us to keep allocations conservative, and although the S&P 500 continued to do well from that point onward, many other segments of the stock market, both domestically and international either made very little headway from that point forward, or registered slight losses during the remainder of the quarter.

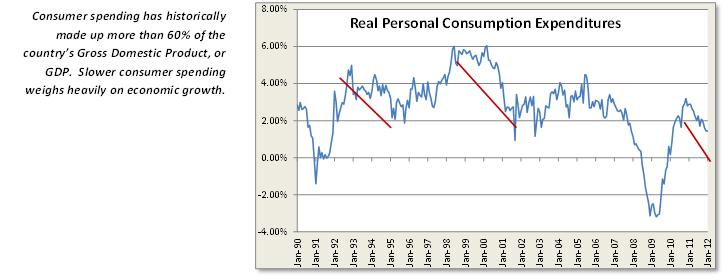

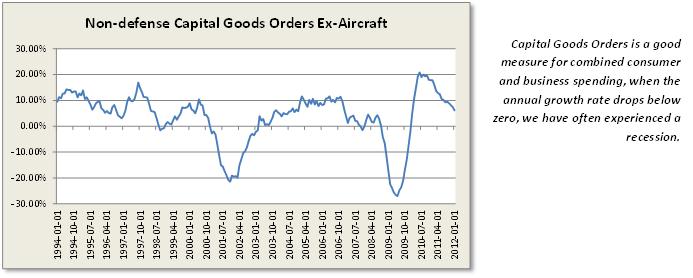

Although stocks can rally without the economy being strong, the stock market can rarely do well over time without a supportive, growing economy. It has been encouraging to see job creation be stronger than expected for the past few months. However, some analysts are saying that job creation has been overstated due to a mild winter pulling hiring forward from spring months and seasonal adjustments made to the data series by the Department of Labor. Over the past couple of years we have seen similar increases in job growth where job gains averaged more than 200,000 per month for more than three months (the spring of 2010 & 2011) only to fall by more than 50% as we moved into the summer months.(1) In addition, when we look at some other data series that are typically more stable, the pace of recovery is continuing to decelerate and reaching levels that have not been supportive of economic or stock market performance. The two charts below illustrate this point

Source: Data for Charts Retrieved From dol.gov (1)

With many signs of an ongoing recession in Europe’s weakest countries and very slow growth for Europe in general, it may compound the existing problems in our economy and pull our tepid recovery back into recession. This is known as “tail risk” or the likelihood that you have a very bad outcome. Due to the ongoing problems that we see in Spain, Portugal and Greece, and the limited remaining options remaining to the World’s Central Banks, extra caution is warranted in this environment. Over the next few months, we expect volatility to increase and we will be closely monitoring the events in Europe and our models.

Michael Ball

Lead Portfolio Manager

(1) Source: Bureau of Labor Statistics Series Id: CES0000000001 (2) Source: Opening Ceremony, China Development Forum 2012

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Weatherstone Capital Management is an SEC Registered Investment Advisor located in Denver, Colorado. Past performance does not guarantee future results.