- Current interest rate environment favors borrowers but is harming savers and fixed income investors

- It will become more important to consider utilizing non-bond alternatives such as funds that own real assets

- The ability to move to cash when interest rates are moving higher to avoid declining bond prices will become important for preserving capital

One of the lingering effects of our last financial crisis and recession is the historically low interest rates we are currently seeing. While the current interest rate environment is quite favorable for borrowers who are able to get loans, it is another story for savers and fixed income investors who are seeing the lowest levels of interest rates in their lifetime. Against this backdrop, I felt it would be worthwhile to spend time this month looking at what may be in store for interest rates, discuss what the risks and opportunities are, and how our income oriented investment strategies are designed to adapt to a changing interest rate environment.

If we look at a long-term history of interest rates as measured by long-term U.S. Government bonds going back to the 1920’s, you will see the current rates are lower than during the Great Depression and World War II. And while our interest rates are currently exceptionally low, this spring and summer we have seen several countries in Europe where the nominal interest rates on short and intermediate-term government bonds went negative where bondholders were essentially paying the government to hold their money.

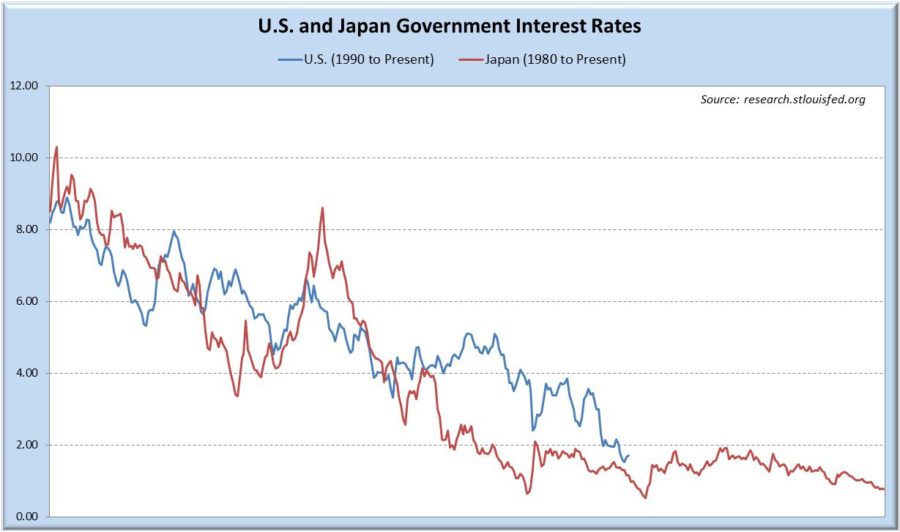

When we look at the two most likely paths for interest rates over the next several years, we could go down the path of Japan, which has experienced a series of financial crises similar to that of the United States in terms of a stock market bubble that burst, a real estate bubble that burst, and extensive and ongoing problems in their banking system. However, their problems started nearly 20 years before our own. As Japan worked to resolve their problems, interest rates declined through a combination of the Government cutting interest rates, and investor demand for bonds over stocks as their economy struggled. Interest rates on 10 year Japanese Government bonds dropped below 2% in the late 1990’s and except for one brief jump back above the 2% range, the rate has stayed below the 2% threshold, and in some cases near the 1% threshold for nearly 15 years.

The other possible path that we could go down is the path that our own economy took after the 1973-74 Recession, which prior to 2008 was the deepest recession since the end of the Great Depression. In an effort to minimize the impact of the Oil Crisis the Federal Reserve cut short-term interest rates significantly, and then kept them low relative to inflation for an extended period of time to review the sluggish economy. As inflation began to build, the Federal Reserve was slow to increase interest rates, and this was one of the primary factors for inflation and short-term interest rates reaching record highs in the early 1980’s.

If we look at the recent quantitive easing programs by the Federal Reserve, they do have some similarities to the policies of the 1970’s, and although most Federal Reserve officials have stated that the Central Bank can remove the stimulus before it would become an inflationary problem, some prominent industry observers and some current and former Federal Reserve Governors are skeptical that it can be done easily. A quote from Bill Gross, manager of the largest bond fund in the world had this to say recently: “Unfair though it may be, an investor should continue to expect an attempted inflationary solution in almost all developed economies over the next few years and even decades.”

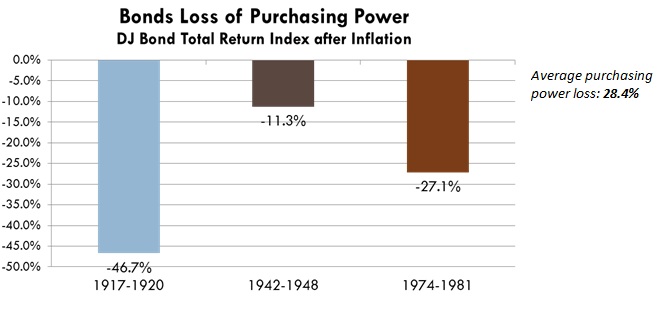

The risk with a path like the 1970’s is that it can negatively impact the value of bonds. As interest rates rise the value of bonds will fall, and the longer the period until a bond matures and the lower the interest rate on the bond, the more it will be negatively impacted as rates move higher. The chart below shows the performance of bonds during prior inflationary periods, and the losses incurred seem more similar to what is seen in a bear market for stocks. Our concern is that for nearly 30 years the trend for interest rates has been to move lower, so losses in the bond portion of the portfolio are typically quite rare and our guess is that most people are unprepared for the possibility of a rising rate environment.

If we end up following the Japan scenario and 1-2% interest rates on longer-term government bonds become normal, then the ability to generate above average income will require a willingness by investors to shift from more inflation sensitive bonds (government bonds) to more economically sensitive bonds (corporate bonds), which is a shift that we are currently seeing. In addition, it will become more important to consider utilizing non-bond alternatives such as funds that own real assets like oil and gas pipelines, utilities, and REIT’s. Additional options include preferred stock and on a risk-managed basis, high dividend paying stocks which are equity backed investment options that generate income levels that are comparable to bonds. Even though some of these areas are currently seeing some selling pressure from expectations of a hike in the tax rate on dividends at the end of the year, the impact will diminish significantly as we enter 2013. In addition, the financial strength of large dividend-paying companies may begin to look more favorable if we see a renewed series of debt defaults. Investment strategies such as our Managed Bond will continue to focus primarily on high yield corporate bonds in this type of environment as they are likely to remain attractive relative to treasuries. For more flexible income-oriented strategies such as our Income Plus, it is expected that the use of non-traditional income producing asset classes would be more heavily used (currently up to 30% of the portfolio), and international bond sectors would likely be a larger portion of the portfolio.

In a period like the 1970’s, the ability to move to cash when interest rates are moving higher to avoid declining bond prices will be important for preserving capital, with periodic moves back into the bond markets when interest rates show periods of stability. In addition, using funds that adjust to higher interest rates such as bank loan funds, treasury inflation protected securities (TIPS), or adjustable rate bond funds can minimize the potential for declining bond prices. In addition, there are also inverse bonds funds which are designed to profit from rising interest rates. Investment strategies such as Managed Bond would most likely spend an above-average amount of time in money market and adjustable-rate bond funds relative to the amount of time that it has spent in high yield corporate bonds funds historically. For more flexible income oriented strategies such as Income Plus, it is expected that inverse bonds funds would be utilized to profit from the increase in interest rates, and adjustable rate funds and bank loan funds would also be used extensively. International bond funds would likely be used if there is better rate stability in foreign countries. Non-traditional income producing asset classes would most likely not be used extensively in such an environment.

This article is not designed to be doom and gloom or to try and determine which outcome is going to be the correct one, but rather to point out that today’s low interest rates poses risks, particularly if we transition back into a more inflationary environment. Being tactical with the fixed income portion of the asset allocation, particularly in a low interest rate environment can be as important as being tactical with your equity exposure. These income strategies have weathered the extreme case of 2008 when we saw the worst performance by corporate bonds since the end of the Great Depression, and they can adapt to extreme cases such as the 1970’s or a low Japanese-style interest rate environment as well.

We wish you Happy Holidays and a great 2013!

Michael Ball

Lead Portfolio Manager

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. Foreign investments are subject to risks including political and economic instability, inflation, deflation or currency devaluation and government limitations. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The Dow Jones Industrial Average is a stock market index made up of 30 large publicly owned companies based in the United States. The index cannot be directly invested in. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.