October turned in a wild ride for financial markets, as stocks, bonds and commodities all had volatile months. There were a number of interesting market moves that we could discuss, but I will just touch on a couple that I feel will be important for the next couple years. In my prior commentary I noted that we had recently seen a dangerous loss of momentum in stocks, due to the combination of market and economic weakness in Europe and renewed concern over debt problems in China, and a potential loss of credibility in Central Bankers and their ability to continue to produce economic growth through quantitive easing programs. Despite some additional volatility in the days following the commentary, markets settled down and rebounded in the second half of the month and market momentum either stabilized or improved in many markets around the world.

As we evaluate the selloff that occurred over the past few weeks, we generally saw declines being larger outside of the United States, and that the declines had started in foreign markets first and then moved to our markets. In addition, the rebound in foreign markets has been smaller than here at home, and this move has been further amplified by the strengthening U.S. dollar. The chart below tells the story better than words can.

When we look at why the stock market recovery here in the U.S. is doing better than most of the rest of the world, one of the primary reasons is that our economy remains stronger than most economies around the world. When we look at recent news headlines out of Europe we see comments from European Central Bank head Mario Draghi stating that the tepid economic recovery in the Eurozone “is losing momentum” and that recent economic indicators have given “no indication” of an upturn since August. (1) In addition, the European Union (EU) recently announced its growth forecasts for the EU and Eurozone (the 18 countries using the Euro). EU growth for this year was downgraded from 1.6% to 1.3% while Eurozone growth was cut from 1.2% to 0.8%.(2) Asia remains slow and China is continuing to see slowing economic growth and levels of new business investment, with U.S. foreign direct investment for the first nine months of the year declining by 24.7%.(3) With the United States seeing the pace of economic growth increase as we go through the year, and interest rates on U.S. government debt remaining at attractive levels relative to many other countries around the world, it makes us a continuing draw for money from around the world to flow into our markets and provide the ability for us to continue to outperform most foreign markets for the time being.

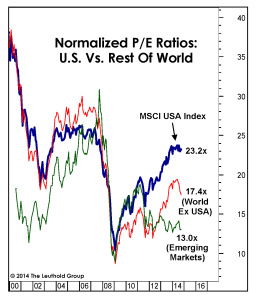

This trend is not without some important longer-term consequences. As the chart below shows, the valuation of our market relative to foreign markets is very wide, with valuation between the United States and the World- U.S. Index near the widest spreads that we have seen over the past 40 years. We have been positive on foreign equities relative to U.S. equities because of the valuation disparity, but with the backdrop of economic weakness and increased geopolitical turmoil we have reduced or eliminated most of our foreign exposure for now and think that the valuation disparity will continue for a while longer. But when foreign valuations do begin to catch up to U.S. valuations (rather than the U.S. coming down to foreign valuations) international markets will likely be an attractive area in which to invest.

An additional area that we are watching is the performance of oil, both as an area that may become attractive for us to invest in, and as a measure of global economic health. This week oil moved to a four year low. While that can be great when you go to the gas pump, it can also signal problems for the global economy. If you look at the chart below, you will see that oil experienced large declines in 2008 and 2011, both times when there was an increase in global economic weakness.

Although there is increasing usage of alternative fuels such as natural gas and electric vehicles, oil remains the primary transportation fuel around the world, and when the economy begins to weaken and people use less of it, the price will fall. In a recent working paper by the International Monetary Fund entitled “Do Asset Price Drops Foreshadow Recessions?” (4) The paper looked at the impact of falling asset prices in G-7 countries and found “Asset price drops are significantly associated with the beginning of a recession…these findings are robust to the inclusion the term-spread…and oil prices.” So energy prices are going to be an important area to watch because a further weakening in oil prices is likely signaling weakening global economic growth, and can have additional implications by causing loss of significant revenue in countries like Russia, and a host of middle eastern countries that are highly dependent on oil and are often economically and socially unstable.

In summary, although we have seen an uptick in volatility recently, the United States looks good from a relative standpoint, but not an absolute standpoint and stands as the best place globally to invest right now. Foreign markets remain attractive from a valuation standpoint, but their returns have been persistently weaker than domestic returns, so we will patiently wait for more favorable times to overweight that segment. The energy sector will likely provide some attractive investment opportunities in the months ahead, but needs to be watched closely as an indicator of weakening economic growth. As always we will continue to monitor the changing financial markets and make adjustments as needed. We appreciate the trust you have placed in us and hope that you have a great Thanksgiving.

Michael Ball

Lead Portfolio Manager

Sources:

1) http://finance.yahoo.com/news/draghi-euro-recovery-losing-momentum-133855637.html

2) http://www.nytimes.com/2014/11/05/business/international/european-union-growth-economy.html?_r=0

3) http://www.reuters.com/article/2014/11/12/us-china-apec-ceos-idUSKCN0IW1EH20141112

4) http://www.imf.org/external/pubs/ft/wp/2013/wp13203.pdf

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. The S&P 500 Index is an unmanaged market capitalization weighted price index composed of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and Over-The-Counter market. Indexes are provided exclusively for comparison purposes only and to provide general information regarding financial markets. This should not be used as a comparison of managed accounts or suitability of investor’s current investment strategies. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. The value of the index varies with the aggregate value of the common equity of each of the 500 companies. The S&P 500 cannot be purchased directly by investors. This index represents asset types which are subject to risk, including loss of principal. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.