- The last time the Dow surpassed its prior all-time high was in late 2006 and continued to move higher by about 20%

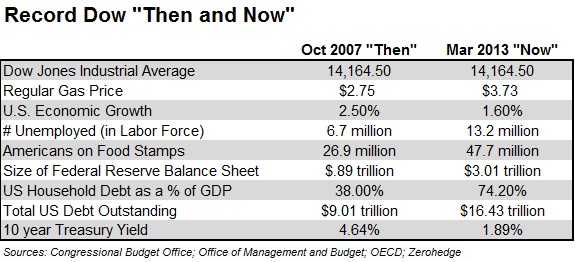

- Key measures of the economy today compared to 2007 show that the economy is not as vibrant as it was in 2007

- The current rally does provide opportunities to make gains in the stock market, and we do have heavier equity exposure than we typically had over the past three years

Last week the Dow Jones Industrial Average (Dow) surpassed its prior record high from October of 2007. As we reach this milestone it’s a good time to evaluate if this milestone is a significant positive development, or if we should be increasingly worried because of the high levels that the market has moved to while the economic recovery has been much more modest. To put the stock market record into context, look at the chart below. The chart depicts the performance of the Dow from late 1999 into early 2009. In late 2006 the Dow surpassed its prior all-time high (orange line) and continued to move higher by about 20% until October of 2007. This move was largely driven by an environment of many corporate buyouts, and a world “awash in liquidity” as nearly every investment had been performing well for a few years and cash was considered a poor place to keep your money.

One of the best performing asset classes over the prior years had been real estate, it was the “can’t lose” investment, and banks were so willing to lend money on real estate that you could borrow up to 125% of your home value, with little or little or no documentation in some cases to actually verify that you could afford the home. However, with such excesses, problems eventually built up under the surface as the quality of loans deteriorated and homes were priced so that more and more people could not afford their payments without pulling equity from their homes. When home prices began to fall, and loans began to default, the economic tide began to turn, and with it the stock market.

Given the underlying problems that were happening as the Dow was reaching its highs in late 2007, was that level justified? Probably not, but when the market is making new highs, most people are focused on the expanded wealth that they are seeing as they look at their investment accounts, not measuring the quality of what is happening under the surface. However, ignoring those underlying factors can cause some unpleasant surprises within a relatively short period of time. When you look at the table below which compares several key measures of the economy today compared to 2007 it is easy to see that the economy is not as vibrant as it was in 2007, and the problems posed by the size of debt, the number of unemployed, etc. is significantly larger now than it was in back then.

There are a variety of factors that can cause the stock market to decline, but the economy is one of the most important. It is probably not a coincidence that the two largest stock market declines since the Great Depression also occurred during the two largest recessions since the Great Depression. When you look at the precarious state of the domestic economy, with subpar economic growth, and earnings for the S&P 500 companies actually declining over the past year, and a struggling global economy that is expected to reach a new record unemployment rate this year, the nearly zero interest rate environment and the resulting actions by investors around the world to move their money into investment that are moving higher in hopes of reaching their retirement goals, or to remain retired this rally has many similarities to the 2006-2007 period. It looks like the current rally to new highs is built largely on hope that the economy can regain its momentum and that investors will pay increasingly high premiums for a dollar’s worth of earnings from stocks than it is a reflection of an improving and robust domestic or global economy.

The current rally does provide opportunities to make gains in the stock market, and we do have heavier equity exposure than we have typically had over the past three years, but we are wary that much like 2006-2007 the stock market rally is not built on a very strong foundation, and that it would not take much to derail the rally and erase much of the market gains from the past few years. This is not a time to become less cautious just because the Dow has moved to a new high.

Michael Ball

Lead Portfolio Manager

Disclosure: Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq and cannot be directly invested in. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.