- Domestic stock indexes performed strongly in the first quarter especially when compared to most foreign markets and asset classes

- Unemployment in the European Union reached 12% in February, a level higher than during the 2007-08 financial crisis

- Our equity exposure remains high relative to the past 2-3 years, however, we remain cautious

The first quarter of 2013 was strong for US stocks, however, outside of our country, or across other asset classes the returns were much more sporadic and muted than one would usually expect given the strength of our market. For example, when you look at the returns of exchange traded funds for some of the major asset classes, those tracking major US stock indexes were typically up about 10%, but those tracking foreign developed markets were up only about 4%, and those tracking the foreign emerging markets were actually down over 3% during the quarter. (1) Most ETFs tracking US Treasury bonds were flat or lower on the quarter as was gold and most commodity indexes. In sum, it was a good quarter if your investment portfolio only held US stocks. The more diversified your portfolio was, the more likely that your return was below the S&P stock index.

As we discussed in our March commentary, (which can be found on our website if you have not signed up to have it emailed to you directly) the important question that we should be evaluating at this juncture is this; Are the levels that we have recently reached for the major market indexes likely to be maintained, or if they are likely to be temporary, similar to the new highs in major market indexes that we saw in 2006-2007?

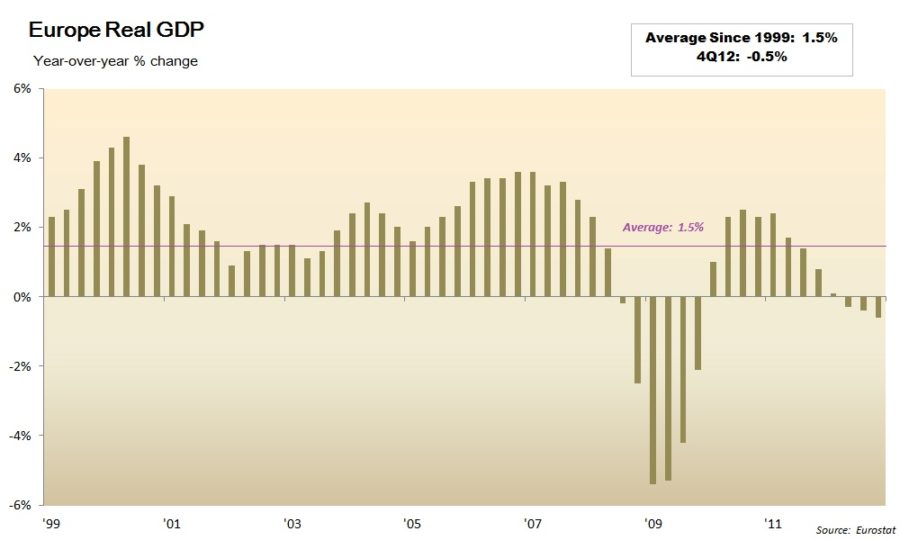

To follow up on that theme, let me note that most of the commentary focused on what was happening inside of the United States. If one looks outside of our country you would see that most foreign markets have not followed us in surpassing their highs before the 2007-2008 financial crises, and that the economic situation internationally looks less positive than it does in our country. The chart below looks at the economic growth rate for Europe, which decelerated and moved back into recessionary territory in 2012, and remains in the contraction zone. In addition, a report by the European Union’s statistics office earlier this month stated that unemployment in the European Union reached 12% in February, this level is higher than the level reached during the 2007-2008 financial crises, and is the highest since the data series started in 1995 (2).

A separate, but perhaps related cautionary note can be found in the levels buying and selling by company “insiders” who typically make investments in their company stock based upon the positive or negative developments they are seeing in their company’s prospects over the next few quarters or years. Levels of selling by insiders has moved to an above-average level not seen since late 2006 and early 2007, which with the benefit of hindsight would have been a pretty good time to sell stock.

Adapting to a Changing Interest Rate Environment – Part II

I would also like to briefly revisit the topic that I discussed in our December commentary regarding challenges to income portfolios if interest rates either remain low or move significantly higher. In the first quarter we saw interest rates rise as measured by Treasury bond yields. Interest rate increases based upon different maturity levels were as follows:

12/31/2012 3/31/2013 5 year Treasury bonds .72% .77% 10 year Treasury Bonds 1.78% 1.87% 30 year treasury bonds 2.95% 3.10% Source: Data provided by Federal Reserve Bank of St. Louis

The modest increase in rates was enough that 10 year treasury ETFs posted a gain of only about .10% for the quarter and the long-term treasury ETFs lost about 2.4% for the quarter due to the impact of rising interest rates causing prices of existing bonds to drop. However, when we step outside of the Treasury bond portion of the income arena there are some areas that did noticeably better. For example, high yield corporate bond ETFs returned about 2% for the quarter while ETFs in areas such as Real Estate, Utilities, and Consumer Products, all areas that yield more than a 30 year treasury gained approximately 8%, 12.9% and 14.5% respectively. (1)

In summary, it was an interesting quarter in the financial markets, with stronger returns in stocks than most people would have expected given the challenges that we had as we came into the new year. The international economic backdrop has deteriorated and has increased the fragility of the underlying support for a continued stock market advance. In bonds we received a brief taste of what we may experience on a more persistent basis if interest rates continue to move higher. While we continue to hold above-average amounts of equities relative to what we have held over the past 2-3 years, we remain cautious that there are an uncomfortable number of similarities to the 2006-2007 period which did see the stock market make new highs, but that it was not based on a good foundation, as evidenced by the significant decline in 2007-2008.

Lead Portfolio Manager

Michael Ball

Sources:

(1) FastTrack Market Data (2) Eurostat: http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/

Disclosure: Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. The S&P 500 Index is an unmanaged market capitalization weighted price index composed of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and Over-The-Counter market. The value of the index varies with the aggregate value of the common equity of each of the 500 companies. The S&P 500 cannot be purchased directly by investors. This index represents asset types which are subject to risk, including loss of principal. This index cannot be directly invested in. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.