In recent commentaries we have talked about the fact that stock market valuations are above-average by historical standards. While this poses significant risk for stocks over the next several years, it does not necessarily mean that they will drop in the next few months. Stocks can continue to move higher so long as there is more demand from buyers who have available cash than there are of sellers wanting to turn their stocks into cash.

One of the things keeping stocks moving higher is the fact that because U.S. stocks have been moving higher over the last couple of years, their recent returns look attractive when compared to money market accounts paying virtually nothing and short-term interest rates available from banks and most bonds. This lack of compelling alternatives has convinced some investors to take on the additional risk in stocks in hopes of a significant reward. When stocks keep moving higher, it can become something of a reinforcing cycle, with the reward from taking on the extra risk drawing others to abandon more conservative investments to take part in the risk as well, in hopes of receiving the reward that they have seen others get.

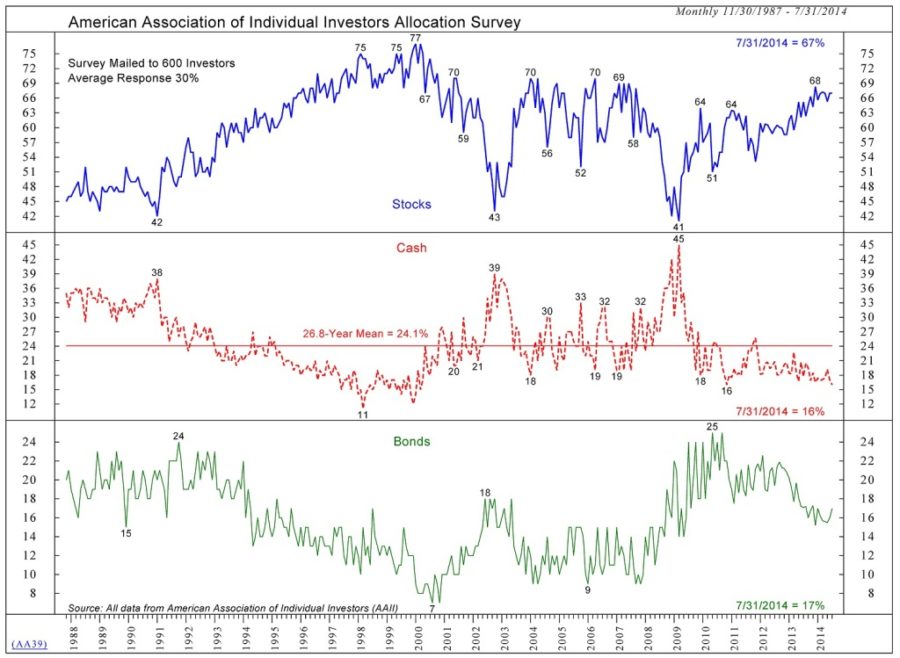

Three of the primary areas where we can look for potential buying power are from investors reducing money market holdings, bond holdings, and borrowing against their stock holdings to purchase stock on margin. For more than 25 years the American Association of Individual Investors (AAII) has been doing a monthly survey of their members asking how their assets are divided between stocks bonds and cash. The chart below shows the historical allocation levels between the three different asset classes. Currently the survey shows an average 67% allocation to stocks, which is above average, but slightly below the peak levels in 2000 and 2007 of 77% and 69% respectively.

When looking at cash, which has had an average allocation of roughly 24%, we see that the current allocation is at 16%, which is historically quite low. To see levels lower than the current 16% level, you have to go back to readings that were in the tail-end of the bull market during the 1998-2000 time-frame. Bonds have also been a beneficiary of low interest rates, at the expense of cash, and currently sit with an average allocation of 17%, which stands well above its lowest reading of 7% in mid-2000. However, it is significantly below the highest reading of 25% which was achieved during 2010. The story here is that to push stocks much higher there will need to be a willingness from individual investors to move toward abnormally low holdings of both bonds and cash. This scenario would tend to run contrary to historical evidence showing that as investors move into retirement they prefer to move out of stocks and into bonds and other income producing investments. With the large number of baby boomers now moving into their retirement years, this has been projected to currently have a negative impact on stocks. However, it is probably being impacted and delayed by the low interest rate environment, since there are fewer appealing choices in the fixed income markets currently.

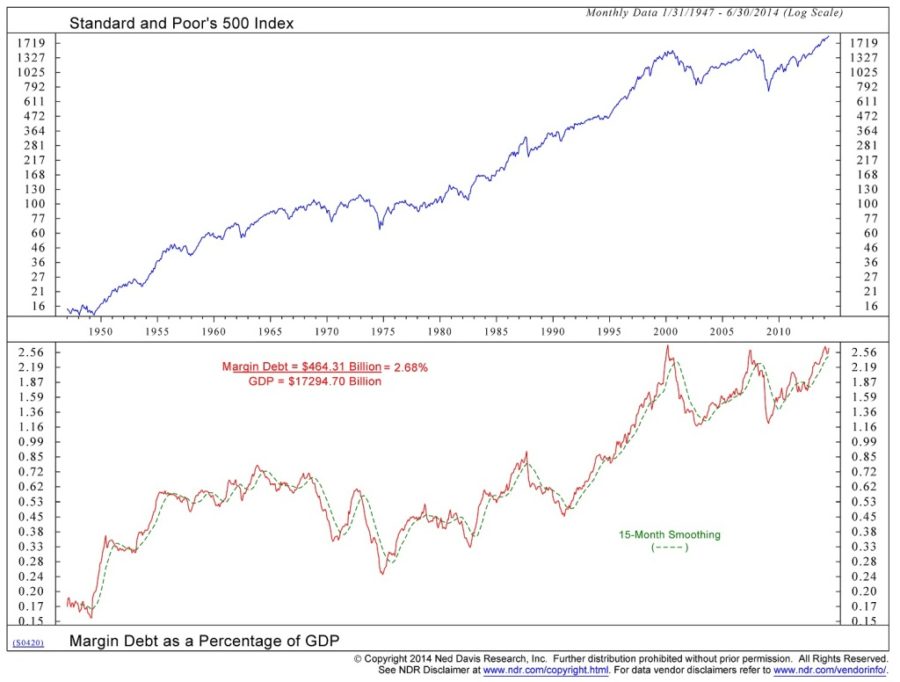

Some aggressive investors are willing to borrow money to purchase stocks. Often these are not just aggressive individual investors, but also large institutional investors such as hedge funds. While margin borrowing can provide additional cash to invest in the financial markets, it is also a double-edged sword, because borrowed money is typically not for long-term investment money and can become a destabilizing force in a market decline when leveraged borrowers may be forced to sell. The first chart shown below shows the amount of margin debt as a percentage of the economy. The chart shows three distinct peaks over the past 15 years, the first at the end of the bull market in late 1999-early 2000, the second in 2007, and the current levels found in today’s market. While the current level is no guarantee that the end of the bull market is imminent, the fact that we are around levels found at prior market peaks suggests that we are at a level where above-average caution is warranted. Although continued buying of stocks on margin is possible and rather inexpensive while interest rates stay low, the stocks purchased on margin have a higher probability of being sold when interest rates rise or when markets begin to decline.

In conclusion, we have a rather unique situation where we have experienced a much larger advance in stocks than would have been expected based upon the strength of the economic recovery in comparison to past economic expansions since the end of WWII. Whether this advance can continue will depend in large part on the willingness of investors to decide if they are comfortable selling bonds and cash when they are already at below-average levels, and the willingness of speculators to continue buying stocks on margin. We will continue to watch these indicators and other measures of potential liquidity for important trend changes that could significantly impact the financial markets.

Michael Ball

Lead Portfolio Manager

Disclosure: Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. The S&P 500 Index is an unmanaged market capitalization weighted price index composed of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and Over-The-Counter market. Indexes are provided exclusively for comparison purposes only and to provide general information regarding financial markets. This should not be used as a comparison of managed accounts or suitability of investor’s current investment strategies. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. The value of the index varies with the aggregate value of the common equity of each of the 500 companies. The S&P 500 cannot be purchased directly by investors. This index represents asset types which are subject to risk, including loss of principal. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.