As I write this commentary on October 11th, we are seeing the stock market as measured by the S&P 500 reach its second correction of 5% or more this year, with the first one being in January and reaching a maximum depth of -5.76%. Historically there has been an average of 3 declines of 5% or more in a year, so the fact that we are just now having our second such decline shows that we have continued to see the continuation of below-average volatility that began last summer. The correction in January was attributed to concerns over the potential for interest rates to rise when the U.S. Federal Reserve (Fed) began the reduction of their bond-buying program. The current decline is beginning to have a more disconcerting global profile.

In last month’s commentary we discussed challenges that are being faced by Europe, with slowing economic growth and declining levels of inflation that may move into deflation. The economic condition of deflation is undesirable because people hold off on buying things because they believe that prices will decline further in the future. Such a cycle makes sustainable economic growth very difficult. Although we have not had that condition on a widespread basis in the U.S. since the Great Depression, we did have it in the housing market after the financial crisis of 2008. Consider the fact that although home prices had fallen significantly from prior levels, many people who could have qualified to purchase a home were unwilling to do so, because they did not have confidence that prices were likely to stop falling. Magnify that to an economy-wide basis and that is what deflation looks like.

Faced with the recent prospects of deflation, the European Central Bank (ECB) has been expected to announce measures that were designed to get commercial banks to make more loans, and thus stimulate the Eurozone (18 member countries all using the eurodollar as a common currency) economy and increase inflationary pressures. One of the first steps which was taken in June was to eliminate the interest rate that it was paying commercial banks who had deposits with the ECB and institute a negative interest rate, so that commercial banks would in essence have to pay to park their money with the ECB. This was designed to put additional pressure on commercial banks to make more loans to more marginal borrowers, and at lower interest rates than they otherwise might.

The more widely expected development as of late was to provide a large amount of additional stimulus to the system through a quantitative easing program similar to what the Fed has done here in the U.S. This step was announced in early September on a scale of nearly $1 trillion in asset purchases. European markets had rallied in August on expectation of the news, and the rally continued into early September after the new policy measure was announced. However, the advance stalled shortly thereafter, and stock markets across Europe have begun to decline again and in many cases are at or near their lowest levels in a year or more.

The fact that the prices of European companies are declining when they should benefit from both lower interest rates and a weaker currency, which makes their exports more competitive on the world market is a troubling sign. It may be signaling that investors have evaluated the situation and feel that despite the current efforts of the ECB, that the steps taken will not be enough to stop deflation, and that they believe the Eurozone economy could slide into a long and difficult recession.

Will the Eurozone problems be large enough to spread and impact the U.S. financial markets? They might, and that is why we are watching this situation very closely on two fronts. The first is the possibility that if the Eurozone slides into recession, that it may also pull us into a recession. Since we came out of our recession in 2009, we saw the Eurozone slide back into a moderate recession in 2012, but that slowdown did not pull us into recession. Although we may not find our current economic recovery to be very satisfying, it is actually one of the strongest in the world, showing us just how weak the global recovery is. So, a weakening Eurozone economy coupled with significant geopolitical tensions have begun to weigh on our markets. My second concern is that it appears an increasing number of investors in Japan have begun to lose faith in some of the similar types of quantitative easing programs which have been implemented over there are not improving things as expected, and their market advance has stagnated. If a similar loss of faith in the Bank of Japan (Japan’s Central Bank) also begins to happen in Europe, could that loss of faith also move to the United States?

What concerns me, and what we have discussed in prior commentaries, is that we have had surprisingly strong stock market growth, yet the weakest economic recovery since the end of WWII. Stocks are now trading at very high valuation levels, and historically we have not been able to maintain these high valuation levels for long periods of time. In regard to how stocks have been able to rise to such high valuation levels in a lackluster economic environment, one reason given by some experts is that with record low interest rates there are no other attractive alternatives, and that because of the lack of compelling alternatives money will continue to flow into the stock markets. While that premise may help explain what has driven stocks to their current valuation levels, it is a premise that sounds too close to the arguments that people were using 10 years ago to justify overvalued housing markets by noting that real estate was safe because “housing has never declined on a nationwide basis in a single year,” and “they aren’t making any more real estate.” We all saw the aftermath of what happened when that premise was realized to be false.

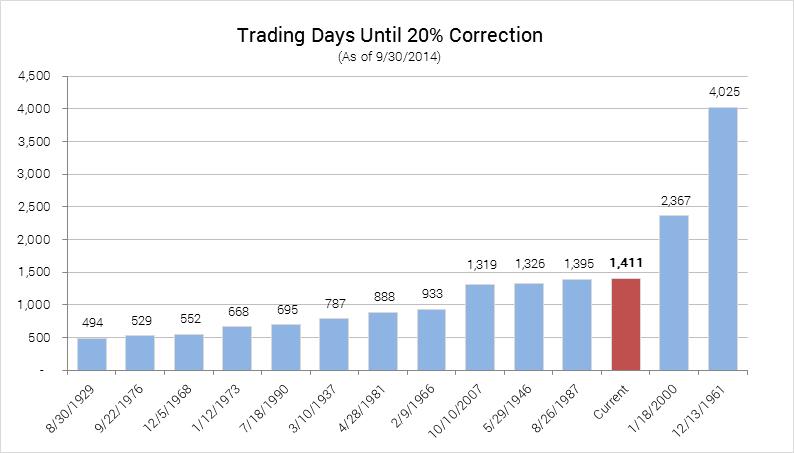

My ultimate concern at this juncture is that we have a very expensive stock market, and we are seeing a loss of upward momentum in stock prices in many global markets, and that decline is now beginning to impact our markets. The U.S. stock market has been providing more positive returns over the past few years than history would suggest that it should, and this has probably been driven by the fact that although our economic situation is not great, it looks better than most parts of the world. The current market advance recently became the 3rd longest in nearly 100 years, as shown in the chart below.

Long bull markets tend to build up complacency on the part of many investors. If the current loss of momentum continues, whether from increasing problems in foreign countries that begin to negatively impact the U.S., a loss of confidence in the ability of the Fed to stimulate the economy, or some other factor, it could significantly reduce the number of investors who are willing to continue putting money into stocks. As a result, many of the recent market participants may sit out until we get to more attractive valuation levels, which could be 20-30% lower than our current levels. Until momentum begins to rebuild, we will continue to reduce equity exposure and remain cautious while we are in this period of above-average risk.

Michael Ball

Lead Portfolio Manager

Opinions expressed are not meant to provide legal, tax, or other professional advice or recommendations. All information has been prepared solely for informational purposes, and is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any securities or instrument or to participate in any particular trading strategy. Investing involves risk, including the possible loss of principal. All opinions and views constitute our judgment as of the date of writing and are subject to change at any time without notice. Investors should consider the investment objectives, risks, charges and expenses of the underlying funds that make up the model portfolios carefully before investing. The ADV Part II document should be read carefully before investing. Please contact a licensed advisor working with Weatherstone to obtain a current copy. The S&P 500 Index is an unmanaged market capitalization weighted price index composed of 500 widely held common stocks listed on the New York Stock Exchange, American Stock Exchange and Over-The-Counter market. Indexes are provided exclusively for comparison purposes only and to provide general information regarding financial markets. This should not be used as a comparison of managed accounts or suitability of investor’s current investment strategies. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. The value of the index varies with the aggregate value of the common equity of each of the 500 companies. The S&P 500 cannot be purchased directly by investors. This index represents asset types which are subject to risk, including loss of principal. If the reader has any question regarding suitability or applicability of any specific issue discussed above, he/she is encouraged to consult with their licensed investment professional. Weatherstone Capital Management is an SEC Registered Investment Advisor with the U.S. Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. Weatherstone Capital Management is not affiliated with any broker/dealer, and works with several broker/dealers to distribute its products and services. Past performance does not guarantee future results.